How Much Credit Card Debt Is Too Much?

In a world where credit cards can either open doors or close them with a swipe, understanding the fine balance between convenience and debt is essential. How much credit card debt is too much? is not just a question—it's a financial checkpoint for anyone swiping their way through life's expenses. This article cuts through the fine print to explore the slippery slope of credit card debt, offering insights into recognizing when you're in too deep and providing strategies to navigate back to financial health.

Recognizing Excessive Debt

The first step towards managing credit card debt is recognizing when it becomes excessive. Signs of overwhelming debt include a high debt-to-income (DTI) ratio, typically over 40%, which indicates a significant portion of your income goes towards debt repayment. Struggling to make even minimum payments, maxing out credit limits, and depending on credit for daily essentials further signal that your credit card debt may be spiraling out of control.

Strategic Debt Management

Effectively managing high credit card debt starts with budgeting. Crafting a detailed budget helps identify unnecessary expenses to cut, freeing up more funds for debt repayment. Prioritizing debts, especially targeting those with the highest interest rates for quicker repayment, can significantly reduce the amount paid in interest over time, making the avalanche method a preferred strategy for many.

Utilizing Balance Transfers

For those with good credit, a strategic move to manage high-interest credit card debt is considering a balance transfer. Transferring debt to a card with a 0% introductory APR offer can pause interest accumulation, allowing payments to directly reduce the principal amount. This window can provide crucial breathing room to lower debt without the added burden of accruing interest.

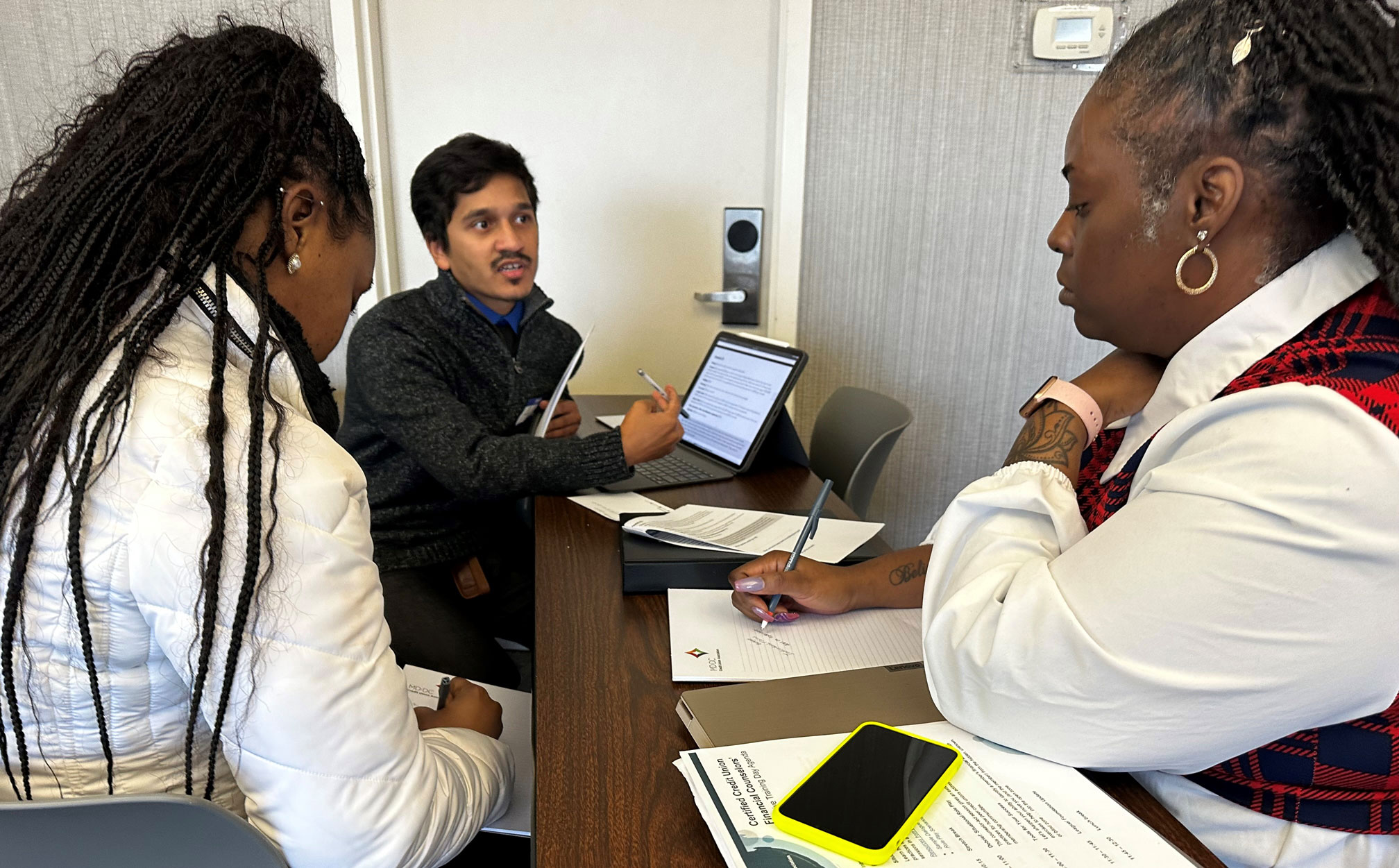

Seeking Professional Guidance

When debt becomes overwhelming, seeking professional advice can make a difference. Credit counselors can offer personalized advice and may suggest a debt management plan as a structured approach to paying down debt. Professional guidance can provide clarity, offer strategies you might not have considered, and help navigate the complexities of debt repayment.

Automating Payments For Consistency

One practical strategy for ensuring consistent debt repayment without accruing late fees or damaging your credit score is automating your payments. By setting up automatic transfers to cover at least the minimum payments on your credit cards, you safeguard against forgetfulness and the risks of irregular payment habits. This approach not only helps maintain a good credit score but also instills discipline in your financial management, allowing for a more focused effort on reducing your overall debt.

The Psychological Impact Of Debt

Beyond the numbers, it's important to consider the psychological impact of carrying too much credit card debt. The stress and anxiety associated with mounting bills can affect not just your mental health but also your physical well-being and personal relationships. Acknowledging the emotional toll of debt is crucial in motivating a more comprehensive approach to debt management. Incorporating stress-reduction techniques, such as mindfulness and physical exercise, can improve your capacity to handle financial pressures, making it easier to focus on long-term solutions for debt reduction.

Achieving Financial Stability

Understanding when credit card debt is too much and taking decisive steps to manage it is crucial for maintaining financial health. Whether through budgeting, prioritizing debts, utilizing balance transfer offers, seeking professional help, automating payments, or addressing the psychological impacts of debt, there are multiple paths to regaining financial stability. Remember, the essence of wise credit use lies in spending within means and having a solid repayment plan.