Debt Consolidation VS Bankruptcy

When you're overwhelmed with debt, it can be difficult to know what to do next. Two of the most common solutions people consider are debt consolidation and bankruptcy. But how do you choose between "Debt Consolidation Vs Bankruptcy"? Understanding the basics of each option is the first step in making an informed decision that best suits your financial situation.

What Is Debt Consolidation?

Debt consolidation involves combining all your debts into a single loan, usually with a lower interest rate. This can simplify your payments, as you'll only have to make one payment each month instead of multiple payments to different creditors. The goal of debt consolidation is to make your debt more manageable and reduce the total amount you pay over time. In the "Debt Consolidation Vs Bankruptcy" debate, consolidation is often seen as the less drastic option.

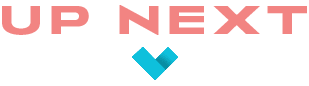

How Does Bankruptcy Work?

Bankruptcy is a legal process that allows individuals who cannot repay their debts to get a fresh start. There are different types of bankruptcy, but the most common for individuals are Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating your assets to pay off as much debt as possible, while Chapter 13 allows you to keep your assets and set up a repayment plan over several years. In "Debt Consolidation Vs Bankruptcy," bankruptcy is typically viewed as a last resort because it can have long-lasting effects on your credit.

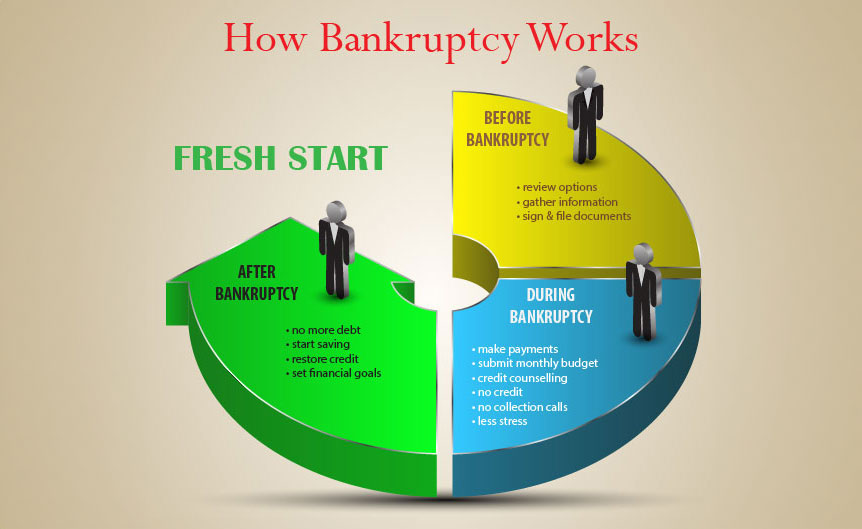

Pros And Cons Of Debt Consolidation

When considering "Debt Consolidation Vs Bankruptcy," it's important to weigh the pros and cons of each. Debt consolidation can simplify your finances and potentially lower your interest rates, making it easier to pay off your debt. However, it doesn't eliminate your debt; it simply restructures it. You also need to have a good enough credit score to qualify for a favorable consolidation loan, and taking out a new loan might not address underlying financial issues.

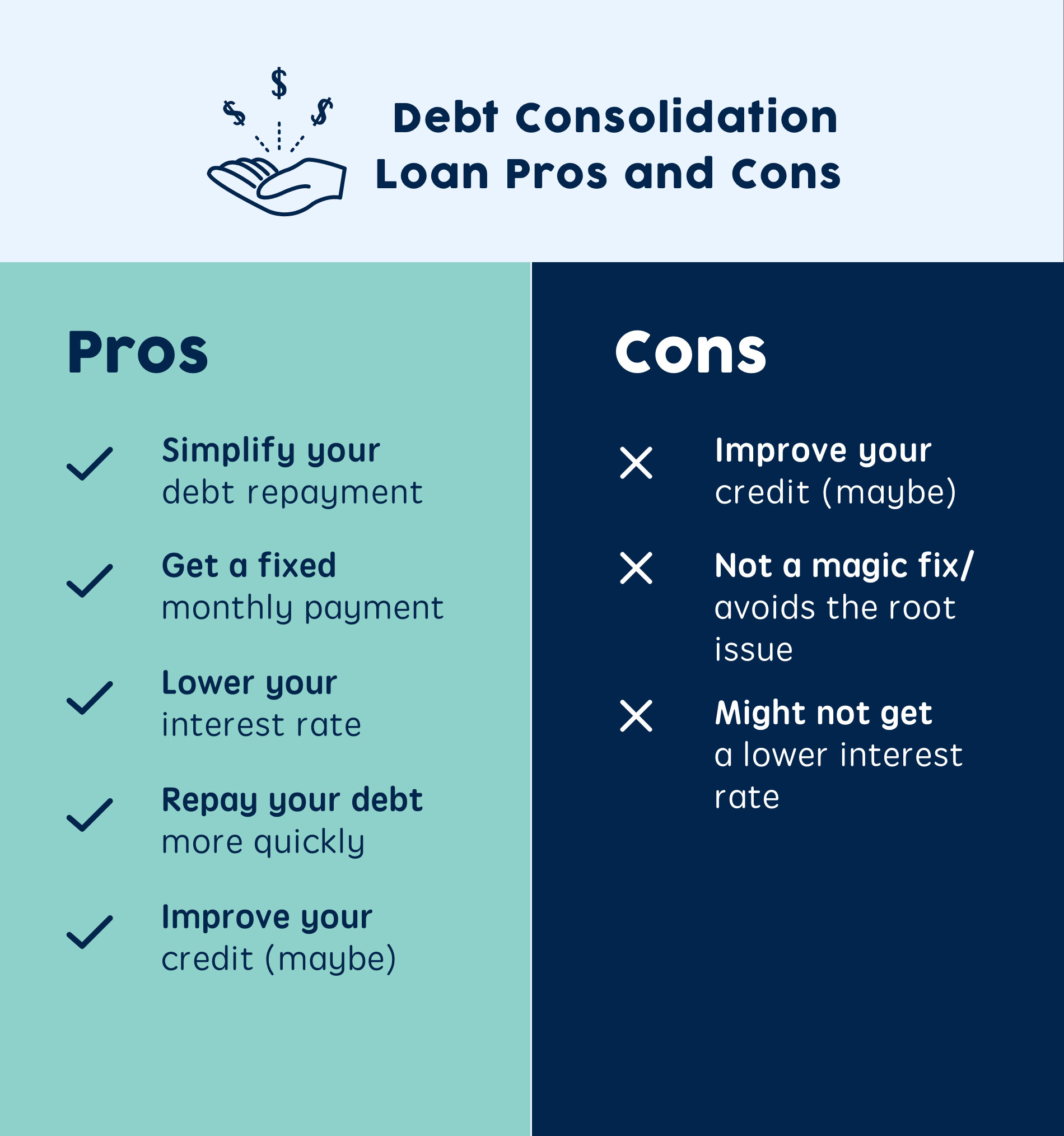

Pros And Cons Of Bankruptcy

Bankruptcy offers the possibility of wiping the slate clean and starting over financially. It can eliminate most of your unsecured debts, like credit card balances and medical bills, and stop collection actions and foreclosures. However, bankruptcy can severely damage your credit score, making it difficult to obtain loans or credit in the future. Additionally, it may require you to give up certain assets, depending on the type of bankruptcy you file. In the "Debt Consolidation Vs Bankruptcy" comparison, bankruptcy can provide relief but at a significant cost.

Which Option Is Better For Your Credit?

When it comes to the impact on your credit, the "Debt Consolidation Vs Bankruptcy" question is crucial. Debt consolidation generally has a less severe impact on your credit score. It shows creditors that you're taking responsibility for your debt and are making an effort to pay it off. On the other hand, bankruptcy can stay on your credit report for up to 10 years, making it harder to secure credit during that time. If maintaining your credit score is a priority, debt consolidation might be the better choice.

When To Choose Debt Consolidation

Debt consolidation might be the right option for you if you have multiple high-interest debts and a steady income that allows you to make regular payments. It's also a good choice if you want to preserve your credit score and avoid the more serious consequences of bankruptcy. In "Debt Consolidation Vs Bankruptcy," consolidation works best when you’re able to manage your debt with some help, rather than needing a complete financial reset.

When To Consider Bankruptcy

Bankruptcy might be necessary if your debt is overwhelming and you see no realistic way to pay it off, even with consolidation. If you're facing foreclosure, wage garnishment, or constant harassment from creditors, bankruptcy could provide the relief you need. It’s also worth considering if your debt is so large that consolidation would still leave you with unmanageable payments. In the "Debt Consolidation Vs Bankruptcy" decision, bankruptcy is a drastic measure but can offer a much-needed fresh start.

Choosing between "Debt Consolidation Vs Bankruptcy" depends on your individual financial situation. Debt consolidation can be a good solution if you have manageable debt and want to protect your credit score, while bankruptcy is better suited for those with insurmountable debt who need a clean break. Before deciding, it's wise to consult with a financial advisor or a bankruptcy attorney to fully understand the implications of each option and make the best choice for your financial future.