When delving into the world of finance, one frequently encountered term is "secured debt." Understanding "What Is Secured Debt?" is essential for anyone managing personal finances, investing, or navigating business operations. As we break down the concept of secured debt, explore its common forms, and discuss its advantages and risks, let’s ensure we don’t let our knowledge bank go bankrupt!

Defining Secured Debt

Secured debt is a loan or form of credit that is backed by collateral. This means that the borrower pledges an asset, such as a house or car, to the lender as security for the loan. The fundamental principle behind secured debt is that it reduces the risk for the lender; if the borrower fails to repay the debt, the lender has the right to seize the asset used as collateral to recover their losses.

Common Types Of Secured Debt

The most typical examples of secured debt include mortgages and auto loans. In a mortgage, the home itself serves as collateral for the loan. If the borrower defaults on a mortgage, the bank can foreclose on the home to recover the amount owed. Similarly, with an auto loan, the vehicle is the collateral, and failure to make payments can result in the car being repossessed by the lender.

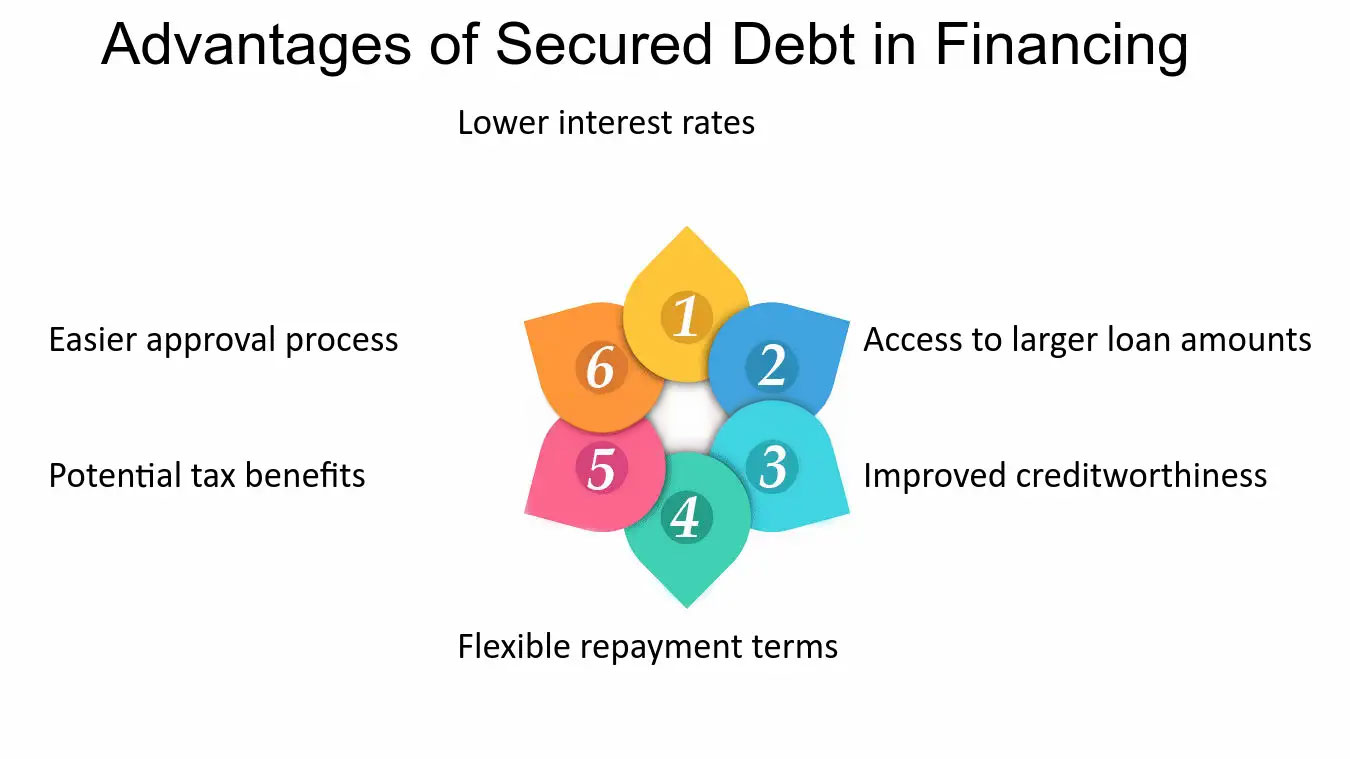

Benefits Of Secured Debt

One of the primary advantages of secured debt is the ability to access lower interest rates compared to unsecured debt. Because the lender's risk is reduced by the presence of collateral, they are generally willing to offer more favorable terms, including lower rates and longer repayment periods. This can make secured loans more affordable in terms of monthly payments.

The Risks Associated With Secured Debt

While secured debt offers several benefits, it also comes with its own set of risks, primarily for the borrower. The biggest risk is the potential loss of the asset. Since the asset guarantees the loan, failing to keep up with payments can lead to repossession or foreclosure. This can have serious long-term effects on a person’s financial stability and credit score.

How Secured Debt Affects Credit Scores

Secured debt can influence your credit score in several ways. Consistent, timely payments on a secured loan can help build your credit history positively. However, any missed payments are likely to be reported to credit bureaus, which can damage your credit score. The impact of secured debt on credit is significant because the amounts borrowed are usually large.

Secured Debt In Business Operations

In the context of business, secured debt is often used to finance the purchase of essential equipment or real estate. Businesses may also use secured loans for expansion or as working capital. Similar to personal secured loans, if a business cannot meet its debt obligations, the lender has the right to seize the asset pledged as collateral.

Considerations Before Taking On Secured Debt

Before taking on secured debt, it is crucial to evaluate your financial situation thoroughly. Ensure that you have the ability to meet the payment obligations under the worst-case financial scenarios. It's also wise to compare different loan offers to find the best terms and to read the fine print regarding repayment terms and potential penalties for late or missed payments.

Alternatives To Secured Debt

For those wary of the risks associated with secured debt, there are alternatives worth considering, such as unsecured loans. These do not require collateral, thus eliminating the risk of losing an asset. However, they typically come with higher interest rates and more stringent credit requirements.

In conclusion, understanding "What Is Secured Debt?" is crucial for making informed financial decisions. Whether you are looking to finance a home, a car, or business equipment, considering both the benefits and risks of secured loans is essential. With careful planning and consideration, secured debt can be a useful tool to meet your financial goals without compromising your financial future.