Advanced Micro Devices (AMD) shares plunged more than 17% on Wednesday despite the chipmaker reporting record fourth-quarter earnings that beat analyst expectations. The dramatic sell-off, which wiped out over $60 billion in market value, highlights the delicate balance between stellar performance and future guidance in today's hyper-sensitive AI investment landscape. As investors digest AMD's $10.27 billion Q4 revenue beat against a weaker-than-expected first-quarter forecast, the question emerges: is this a healthy market correction or the beginning of a larger AI chip reckoning?

How AMD's Record Quarter Triggered a Market Panic

On the surface, AMD's Q4 2025 results represented everything investors could want from a leading AI chip contender. The company reported adjusted earnings per share of $1.53, crushing the $1.32 consensus estimate, while revenue surged 34% year-over-year to $10.27 billion against expectations of $9.67 billion. For the full year 2025, AMD achieved record revenue of $34.6 billion with a 50% gross margin, generating $3.7 billion in operating income and $4.3 billion in net income.

Yet within hours of the earnings release, AMD stock tumbled 17.3% to close at $200.19, its worst single-day decline in over two years. The disconnect between performance and market reaction stems from what analysts describe as "good, but not great" guidance. While AMD projected Q1 2026 revenue between $9.5 billion and $10.1 billion—above the $9.37 billion consensus—the midpoint represents a sequential decline from Q4's record results.

"The market was prepared for flawless performance, and AMD delivered excellence with a hint of caution," said Wedbush Securities analyst Matt Bryson in a research note. "When you're trading at AI premium valuations, even minor guidance concerns get magnified."

From All-Time Highs to 17% Drop: The AMD Timeline

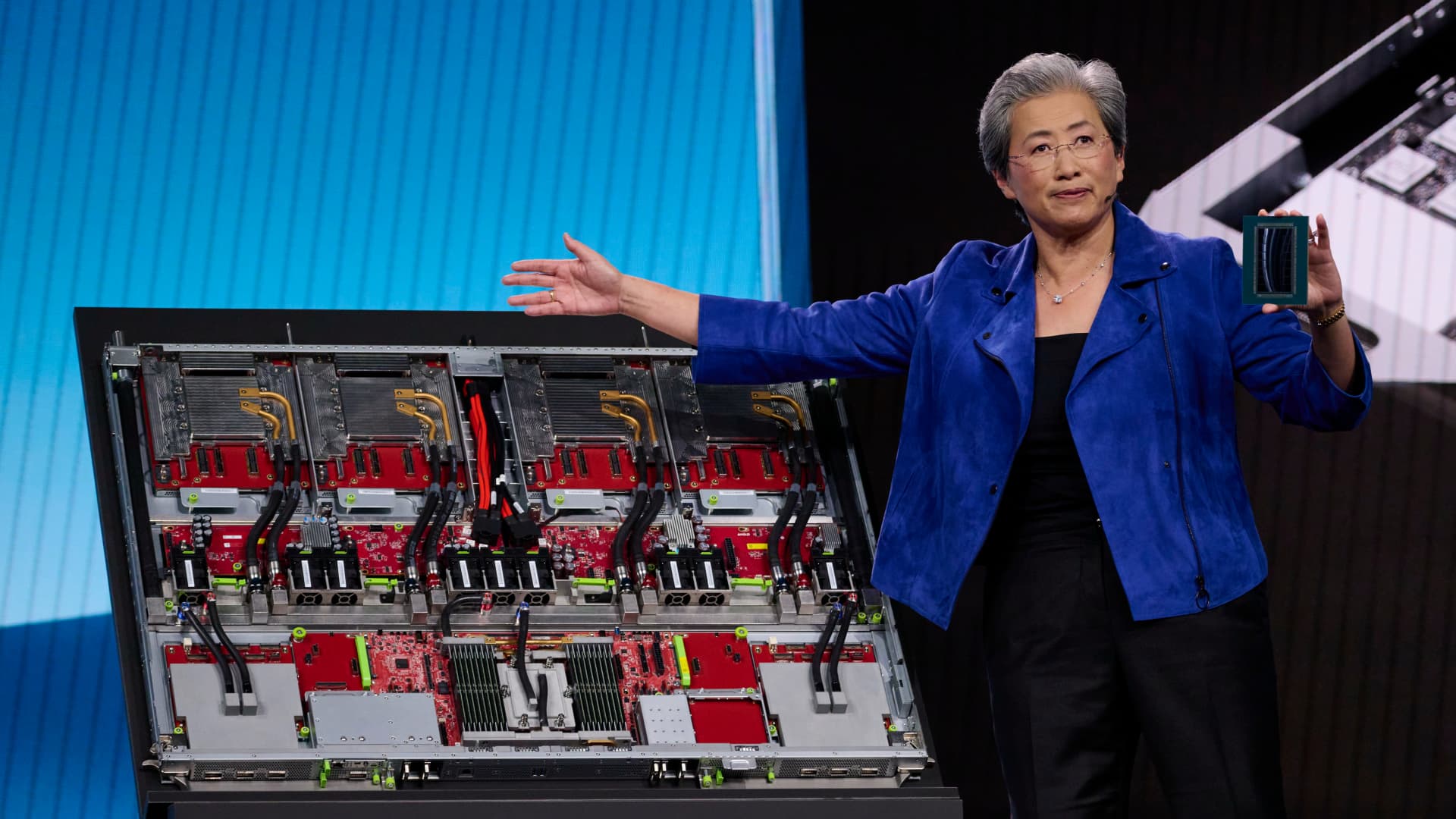

The recent volatility contrasts sharply with AMD's remarkable 2025 performance. The stock reached its all-time high of $267.08 on October 29, 2025, capping a 118% yearly gain driven by AI optimism. However, the seeds of Wednesday's decline were sown during the earnings call when CEO Lisa Su disclosed that AI chip revenue linked to China would be limited to "less than $100 million" in Q1 due to licensing uncertainties.

Key Moments in AMD's Recent Journey:

- October 29, 2025: AMD hits record high of $267.08, fueled by AI chip demand expectations

- February 3, 2026: AMD releases Q4 2025 earnings after market close, beating revenue and EPS estimates

- February 4, 2026: Stock plunges 17% as guidance disappoints, closing at $200.19

- February 5, 2026: Analyst reactions flood in with mixed price target adjustments

The timing is particularly sensitive as investors compare AMD's trajectory with industry leader Nvidia, which continues to dominate the AI accelerator market. "AMD is being held to Nvidia's standard, and any sign of sequential weakness triggers immediate comparisons," noted RBC Capital Markets analyst Mitch Steves.

Why AI Chip Stocks Are Facing Reality Check

The AMD sell-off reflects broader concerns about AI chip valuations after a spectacular 2025 rally. With AMD trading at approximately 40 times forward earnings before the drop—compared to the S&P 500's average of 20—even minor guidance issues can trigger disproportionate reactions.

Three factors are amplifying the pressure on AI chip stocks:

- China Restrictions: U.S. export controls continue to limit AI chip sales to Chinese customers, representing a significant revenue constraint for AMD. CEO Lisa Su acknowledged the company "is not forecasting any China AI chip revenue beyond $100 million in Q1" amid licensing uncertainty.

- Sequential Guidance: While AMD's Q1 revenue guidance exceeds analyst estimates, the $9.8 billion midpoint represents a 5% decline from Q4 2025—a concerning trend for growth investors.

- Competitive Pressure: Nvidia's continued dominance in AI training chips creates persistent comparisons, with AMD needing to demonstrate sustained market share gains to justify its valuation.

Despite these challenges, several analysts maintain bullish long-term outlooks. "AMD's fundamental story remains intact," wrote Morgan Stanley's Joseph Moore, who maintains an Overweight rating with a $270 price target. "The sell-off creates an attractive entry point for investors with a 12-18 month horizon."

Where AMD Stands After the Sell-Off

Following Wednesday's decline, AMD shares stabilized in Thursday's pre-market trading, indicating the initial panic may be subsiding. The stock's current price of approximately $202 represents a 24% discount from its October peak but remains 64% above its level from one year ago.

Key metrics after the sell-off:

- Market Capitalization: $327 billion (down from $390 billion pre-earnings)

- Price-to-Earnings Ratio: 35x forward earnings (down from 42x)

- Dividend Yield: 0.3% (unchanged)

- Analyst Consensus: 28 "Buy" ratings, 8 "Hold," 2 "Sell"

Notably, AMD's valuation now aligns more closely with historical semiconductor industry averages while still maintaining a premium for its AI growth potential. "The market has removed some of the froth but continues to price in substantial AI-driven growth," observed Goldman Sachs analyst Toshiya Hari.

The Road Ahead for AMD and AI Chip Demand

Looking forward, AMD's trajectory will depend on several critical developments in the coming quarters. The company's MI300X accelerator series continues to gain traction in data centers, with management noting "strong demand" from cloud providers and enterprise customers. However, the true test will be whether AMD can convert design wins into meaningful revenue growth that exceeds current guidance.

Upcoming catalysts for AMD investors:

- Q1 2026 Earnings (April 2026): Will actual results exceed the cautious guidance?

- AI Chip Launches: Next-generation MI400 series expected in late 2026

- China Policy Developments: Potential easing of export restrictions could open significant market

- Competitive Dynamics: Nvidia's Blackwell platform launch may intensify price competition

CEO Lisa Su remains optimistic, telling investors on the earnings call that "AI is accelerating at a pace that I would not have imagined." She emphasized that demand for AMD's products "is on fire" across cloud, enterprise, and edge computing segments.

Key Points for Investors

For investors navigating the AMD volatility, several clear takeaways emerge from the earnings episode:

- AMD's fundamental business remains strong with record revenue and profitability

- The 17% sell-off reflects guidance concerns rather than performance deterioration

- AI chip stocks face heightened sensitivity to sequential growth metrics

- China restrictions represent a near-term headwind but not a long-term barrier

- The valuation reset may create buying opportunities for patient investors

As the AI chip market matures from hype-driven speculation to execution-focused evaluation, companies like AMD will need to demonstrate consistent quarter-over-quarter growth to maintain premium valuations. Wednesday's dramatic reaction serves as a reminder that in today's market, even excellent performance must be accompanied by flawless forward guidance.