Meta Platforms (META) shares surged 10% in extended trading after the social media giant reported fourth-quarter earnings that beat expectations, but the real story is the company's staggering $135 billion AI investment plan for 2026. As Wall Street grapples with the implications of Meta's massive capital expenditure forecast, investors are asking whether this aggressive spending will deliver the 'superintelligence' CEO Mark Zuckerberg promises or become another costly misstep like the Metaverse.

How Meta's Earnings Surprise Sparked a 10% Stock Rally

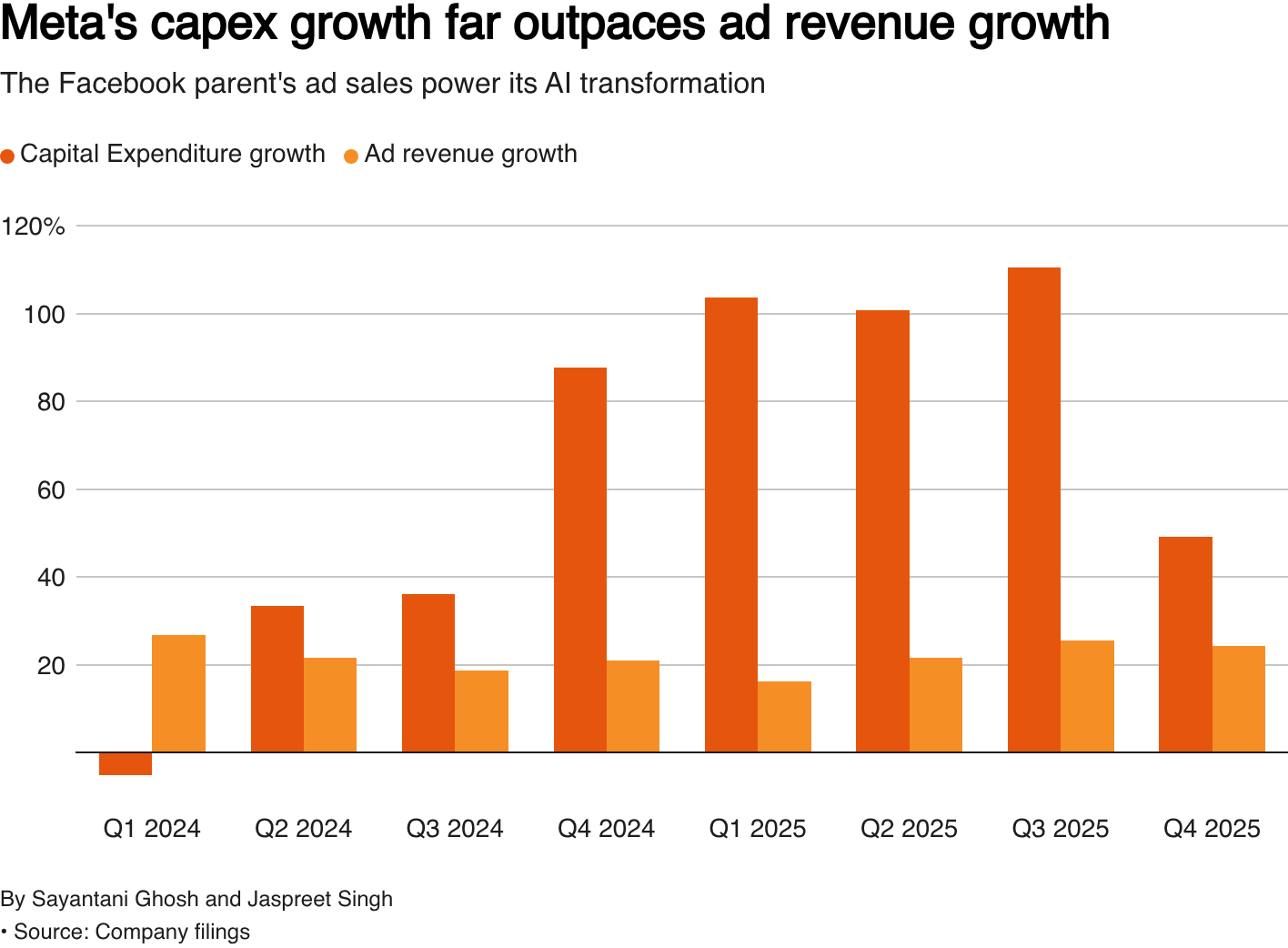

On January 28, 2026, Meta released fourth-quarter results that showed revenue growth of 24% year-over-year to $59.89 billion, beating analyst estimates of $58.14 billion. Earnings per share reached $8.88, exceeding expectations by $0.72. The immediate market reaction was positive, with shares jumping 10% in after-hours trading, but the more significant development was Meta's guidance for 2026 capital expenditures ranging from $115 billion to $135 billion—a 73% increase from 2025 levels.

According to Reuters, Meta's advertising business remains the engine driving this investment, with Q4 ad revenue surging to $58.14 billion from $46.78 billion a year earlier. However, operating margins contracted by 700 basis points to 41% as AI-related costs mounted. "This is going to be a big year for delivering personal superintelligence, accelerating our business infrastructure for the future and shaping how our company will work going forward," CEO Mark Zuckerberg told analysts on the earnings call.

From Metaverse to AI: Meta's Strategic Pivot Over the Past Year

Meta's massive AI investment represents a significant strategic shift from its previous focus on the Metaverse, which has consumed nearly $80 billion with limited returns. According to Seeking Alpha analysis, Meta is now redirecting resources toward AI infrastructure and wearables, particularly Meta AI glasses, positioning Reality Labs for growth inflection in early fiscal 2026.

The timeline of Meta's AI acceleration reveals a company playing catch-up in a competitive field. In 2025, Meta signed multi-billion dollar cloud contracts with Alphabet's Google, CoreWeave, and Nebius to address internal capacity constraints. By Q4 2025, the company's capital expenditures had already risen 49%, outpacing total revenue growth of 24%. Chief Financial Officer Susan Li warned that capacity constraints would persist through much of 2026, necessitating continued heavy investment.

Why Wall Street Is Betting Big on Meta's AI Spending

Despite near-term margin compression, analysts see Meta's AI investment as necessary groundwork for future profitability. Morningstar maintains a $850 fair value estimate for Meta, citing the company's "wide economic moat" and the strategic importance of AI to its core advertising business. Engagement metrics remain strong, with time spent on Instagram and Facebook increasing and video engagement particularly robust.

"Meta is an example where the valuation is really not that demanding," said John Belton, portfolio manager at Gabelli Funds, in comments to Reuters. "The returns are enormous today—they're just not coming on the generative AI side of the business. They're coming from the core business, which is being helped by AI infrastructure."

Seeking Alpha upgraded Meta to "Strong Buy" with a $893 price target, noting that current valuation at 16.61x EV/EBITDA offers an appealing entry point ahead of anticipated AI-driven gains. The analysis highlights Meta's healthy balance sheet and strong free cash flow generation as buffers against the substantial capital outlays.

Where Meta Stands Now: Valuation and Market Position

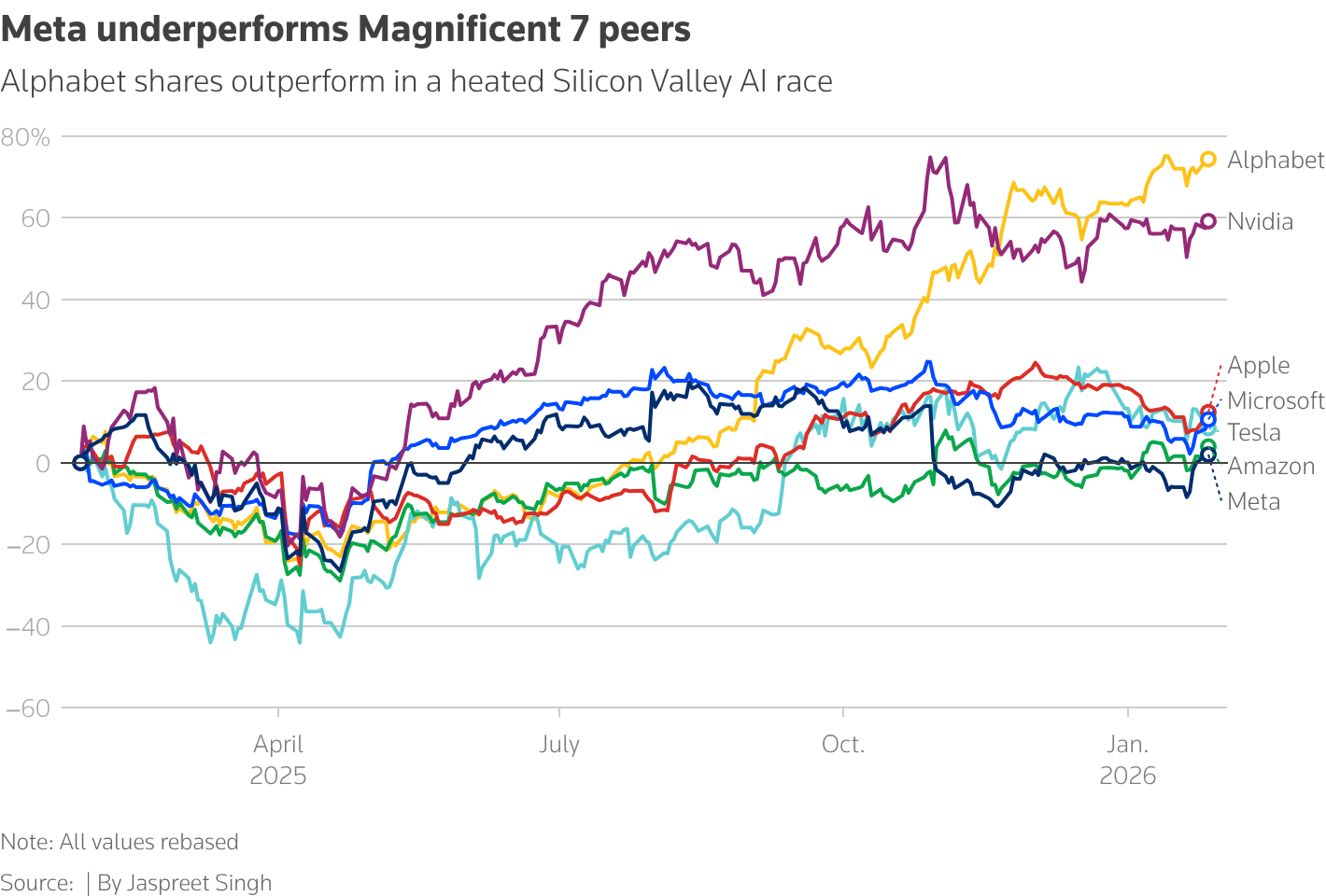

As of February 2026, Meta trades at 22.2 times forward earnings estimates, compared to 29.5 for Alphabet, 30 for Amazon.com, and 27.1 for Microsoft. This relative discount reflects investor concerns about the AI spending ramp but also creates potential upside if the strategy succeeds. The company's Q1 2026 revenue guidance of $53.5-56.5 billion exceeds analyst expectations of $51.41 billion, suggesting continued advertising resilience.

Morningstar's analysis indicates that Meta's advertising platform benefits directly from AI investments, with ad clicks increasing 3.5% on Facebook and conversions rising 1% on Instagram during Q4. These marginal improvements translate into substantial revenue given Meta's scale, with ad impressions up 18% for the quarter.

The Road Ahead: Can Meta Deliver on Its AI Promises?

Jesse Cohen, senior analyst at Investing.com, told Reuters that long-term investors likely view 2026 as a necessary transitional year where Meta's advertising business generates sufficient cash flow to fund its AI transformation. The key question is whether Meta can achieve "superintelligence"—a theoretical milestone where machines outthink humans—before competition intensifies and margins erode further.

Meta faces challenges on multiple fronts: competition from TikTok and YouTube Shorts in short-form video, regulatory scrutiny over social media addiction, and the need to attract top AI talent in a heated market. However, with $22.77 billion in Q4 net income (a 38% net margin) and $162-169 billion in projected 2026 total expenses, the company has substantial resources to deploy.

Key Points for Investors

Meta's current investment thesis revolves around three critical factors: the scalability of AI infrastructure spending, the monetization potential of AI-enhanced advertising, and the company's ability to maintain its wide economic moat during this transition. While near-term margin compression is inevitable, analysts generally agree that Meta's strong core business provides a buffer during this investment phase. The stock's relatively modest valuation compared to tech peers suggests that significant AI success could drive substantial upside, while the advertising foundation limits downside risk.

As Zuckerberg's ambitious vision unfolds through 2026, investors should monitor quarterly capex reports, advertising margin trends, and any tangible product launches from the AI investment. The coming months will reveal whether Meta's $135 billion bet represents visionary leadership or excessive ambition in the rapidly evolving AI landscape.