Palantir Technologies (PLTR) is experiencing one of the most remarkable stock rallies of 2025, with shares surging more than 50% year-to-date and hitting multiple record highs. Behind this extraordinary performance lies an unlikely force: retail investors. While Wall Street analysts have often been skeptical of Palantir's premium valuation, individual investors have poured billions into the AI analytics company, making it the third most-traded stock among retail traders—trailing only Nvidia and Tesla. The company's latest earnings report only fueled the frenzy, with Q3 2025 revenue jumping 63% year-over-year and U.S. commercial revenue more than doubling. As CEO Alex Karp continues to embrace his retail fanbase, the question isn't whether Palantir is growing—it's whether the stock's astronomical valuation can sustain its breathtaking ascent.

The Retail Investor Frenzy: How Main Street Is Beating Wall Street

In a remarkable shift from traditional market dynamics, retail investors have become the primary drivers of Palantir's stock performance. According to data from Vanda Research, retail purchases of Palantir stock reached $339.72 million in just one week in February 2025, placing it behind only Nvidia ($579.14 million) and Tesla ($562.20 million) in retail popularity. This isn't accidental—Palantir's leadership has actively courted individual investors since the company's direct listing in 2020, which allowed retail investors to buy shares at the same price as institutions. "It's not cookie-cutter Wall Street, but Palantir's changing the technology space, and retail understood that," Wedbush analyst Dan Ives told Business Insider. The company's dedicated subreddit r/PLTR has grown to nearly 100,000 members, while CEO Alex Karp frequently addresses retail investors before taking questions from Wall Street analysts during earnings calls.

For individual investors like Katherine H., a 60-year-old personal chef from Florida, Palantir's surge has been life-changing. After losing her home and possessions to Hurricane Helene, the appreciation of her 1,000-share position—purchased at an average cost of $14—has generated over $100,000 in profits. "It came at such a time, for me personally, that it gives me much needed encouragement," she told Business Insider. Similar stories abound across social media, where retail investors share how Palantir has transformed their financial situations. This grassroots support has created a virtuous cycle: as more retail investors buy and hold, the stock price rises, attracting even more attention.

From $5 to $175: The Meteoric Rise of Palantir Stock

Palantir's journey from controversial data analytics startup to AI powerhouse has been nothing short of spectacular. After going public in September 2020 at around $10 per share, the stock languished for years, trading between $5 and $30 until late 2023. Then everything changed. The AI revolution, coupled with Palantir's Artificial Intelligence Platform (AIP) launch, sparked a 341% surge in 2024—followed by another 50%+ gain in the first months of 2025. Key milestones include February 2025, when Palantir's market capitalization crossed $200 billion as shares hit $106.91, and November 2025, when Q3 earnings revealed staggering growth metrics. The company has since announced major contracts, including a $10 billion deal with the U.S. Army and partnerships with Snowflake, Lumen, and Nvidia. What began as a niche government contractor has transformed into a diversified AI platform serving both public and private sectors.

Valuation vs. Growth: The Great Palantir Debate

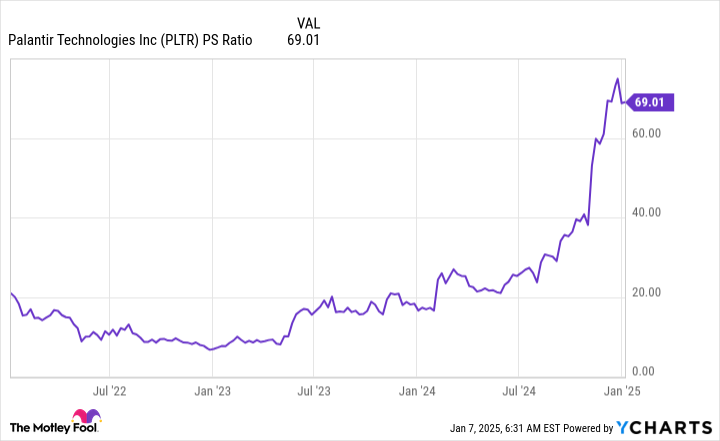

While Palantir's growth story is undeniable, its valuation has become a point of intense debate among analysts. The stock currently trades at approximately 69 times sales—more than triple the typical software company's multiple of 10-20 times sales. For comparison, even Nvidia during its peak growth phase never exceeded 46 times sales. "Investors are paying a massive premium for Palantir's stock over other software companies that are growing just as fast," warns Motley Fool analyst Keithen Drury. The concern is that Palantir's current price already bakes in years of future growth, leaving little room for upside. However, bulls counter that traditional valuation metrics don't apply to category-defining AI leaders. D.A. Davidson's Gil Luria calls Palantir "the best software company and it's not even close," citing its unique position at the intersection of government contracts and commercial AI adoption. The company's profitability adds to the bull case: Palantir maintains approximately 20% net margins while investing heavily in growth.

Where Palantir Stands Today: Record Highs and Rising Expectations

As of early 2026, Palantir shares trade around $174, giving the company a market capitalization exceeding $400 billion—making it one of the world's most valuable technology companies. The stock's performance has defied broader market trends, particularly in the technology sector where many AI names have faced corrections. Recent quarterly results continue to impress: Q3 2025 revenue reached $1.18 billion (beating estimates of $1.09 billion), while U.S. commercial revenue exploded by 121% year-over-year. Government sales, historically Palantir's foundation, grew 52% to $486 million. Perhaps most importantly, management raised full-year 2025 revenue guidance to $4.4 billion (up from previous estimates) and projected Q4 revenue of approximately $1.33 billion—both figures crushing consensus expectations. With retail ownership at record levels and institutional interest growing, Palantir shows no signs of slowing down.

The Road Ahead: Can Palantir Maintain Its Momentum?

Looking forward, Palantir faces both tremendous opportunities and significant challenges. On the positive side, the company's AIP platform continues gaining traction across industries, from healthcare to financial services. Government contracts remain robust, with national defense and intelligence agencies increasingly relying on Palantir's analytics. However, competition is intensifying as tech giants like Microsoft, Google, and Amazon enhance their own AI offerings. Valuation remains the elephant in the room: any disappointment in growth could trigger a severe correction. CEO Alex Karp acknowledges the AI market's excesses, stating, "The strong companies are going to get much stronger, and the people pretending they're doing stuff are going to disappear very quickly." For retail investors who have ridden Palantir's incredible run, the decision now is whether to take profits or hold for the long term. Most analysts agree that while Palantir the company is thriving, Palantir the stock may need time to grow into its valuation.

Key Takeaways from the Palantir Phenomenon

The Palantir story offers several crucial lessons for investors. First, retail investors can indeed move markets, especially when united around a compelling narrative. Second, CEO engagement matters—Alex Karp's unconventional approach has cultivated loyal shareholders who believe in the mission, not just the financials. Third, growth at any price carries risks, and valuation discipline remains essential even in exciting sectors like AI. Finally, Palantir demonstrates how technology companies can successfully bridge government and commercial markets, creating durable competitive advantages. Whether Palantir's stock continues its record-breaking run or faces a reality check, one thing is certain: the company has permanently changed how investors think about the intersection of AI, data analytics, and shareholder democracy.