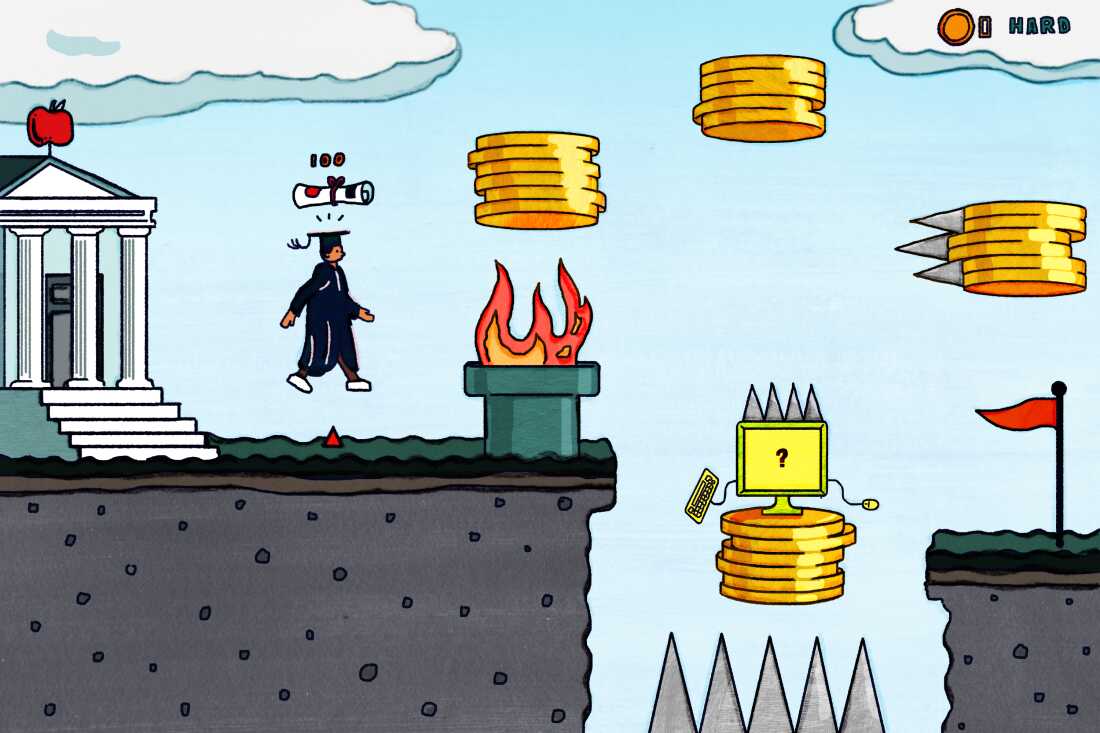

For millions of Americans, the choice between paying down student loan debt and saving for retirement has long felt like a financial zero-sum game. But a transformative change in retirement law is creating new opportunities to do both simultaneously, while sweeping reforms to the federal student loan system are poised to reshape borrowing and repayment for generations to come. The SECURE 2.0 Act, passed in 2022 but now gaining real traction, allows employers to match student loan payments with 401(k) contributions—creating what financial experts call a "bridge from debt to retirement security." This comes as the federal student loan system prepares for its most dramatic overhaul in decades, with the popular SAVE repayment plan ending and new borrowing limits taking effect in July 2026.

The SECURE 2.0 Breakthrough: How Student Loan Payments Now Build Retirement

Starting with plan years after December 31, 2023, the SECURE 2.0 Act introduced what's formally known as the Qualified Student Loan Payment (QSLP) match program. Under this provision, employers can make matching contributions to employees' retirement accounts based on their qualified student loan payments, treating those payments as if they were salary deferrals into a 401(k), 403(b), SIMPLE IRA, or government 457(b) plan. "The law's 401(k) student loan match program helps U.S. workers at participating employers avoid the dilemma of trying to grow a nest egg for the future while paying down student loans now," explains Business Insider's coverage of the program.

The mechanics are straightforward but revolutionary. If your employer offers a 50% match on the first 6% of salary contributed to your 401(k), and you make $500 in student loan payments each month, your employer could contribute $250 to your retirement account—even if you're not making any traditional 401(k) contributions at all. The IRS issued interim guidance on August 19, 2024, clarifying that all employees eligible for regular employer matches qualify for student loan matches, with the same vesting rules and contribution limits applying. "Student loan debt can be a significant drain on household income, shifting resources away from basic necessities, retirement savings, and other goals such as purchasing a home," says Teresa Greenip, CFP, senior manager in wealth management at Aspiriant.

Timeline: How Student Loan Policies Are Transforming Before Our Eyes

The current landscape represents a convergence of multiple policy changes with staggered implementation dates. The SECURE 2.0 student loan match provision took effect in 2024, but employer adoption has been gradual as companies navigate the administrative complexities. Meanwhile, the federal student loan system is undergoing its own transformation: the Biden administration's SAVE repayment plan is being dismantled through a December 2025 settlement agreement, with 7 million borrowers to be moved to other plans. Come July 1, 2026, new borrowing limits will cap graduate student loans at $20,500 annually (with professional degrees at $50,000) and parent PLUS loans at $65,000 per child.

"We've got about 12 million borrowers right now who are either delinquent on their loans or in default," warns Preston Cooper, a student loan policy researcher at the American Enterprise Institute, whose analysis of federal data shows 5.5 million borrowers in default, another 3.7 million more than 270 days late, and 2.7 million in early delinquency. The Education Department has confirmed it will resume wage garnishment for defaulted borrowers in early 2026, adding urgency to the search for sustainable repayment solutions.

Why Student Debt Changes Everything About Financial Planning

New research from MissionSquare Research Institute reveals just how profoundly student loan debt influences financial behavior and career decisions. Their survey of 2,036 workers found that student debt affects job acceptance decisions for 56% of public sector employees and 62% of private sector employees. Perhaps more concerning for long-term financial health, employees with student debt are less likely to remain with their current employer compared to those without student debt (39% vs. 61%), and they're significantly more likely to have shorter financial planning horizons and avoid investing altogether.

"Student debt triggers an emphasis on short-term planning, short-term investment, or not investing at all," says Zhikun Liu, PhD, CFP®, Head of MissionSquare Research Institute. "This restricts student debt holders' opportunities to benefit from investment compounding, hindering their ability to accumulate wealth." The research shows employees with student debt are 14% more likely in the public sector and 9% more likely in the private sector to perceive their retirement savings as inadequate compared to debt-free peers—a perception gap that the SECURE 2.0 matching program aims to address.

Where Things Stand Now: Adoption and Implementation Challenges

While the SECURE 2.0 student loan match represents a theoretical breakthrough, practical implementation has faced hurdles. "Employee deferrals to retirement plans are administered by employers themselves, so it's relatively easy to track contributions," Greenip explains. "Since employers do not track student loan repayments, this adds a layer of complexity and administrative support that will be needed to offer the benefit." Financial institutions are stepping in to fill this gap: Charles Schwab Retirement Plan Services announced a collaboration with student loan platform Candidly in April 2025 to provide integrated solutions for employers implementing the match.

"By integrating Candidly's technology with Schwab Retirement Plan Services' capabilities, we're helping employers transform student debt from a financial barrier into a bridge to retirement security," says Laurel Taylor, Founder and CEO of Candidly. Schwab's solution helps employers verify student loan payments and automate matching contributions, addressing what had been a major administrative obstacle. Meanwhile, borrowers face their own uncertainties as the SAVE plan winds down, with the Education Department promising "guidance about how to repay their student loans in the coming weeks" but providing few concrete details about transition timelines.

What Happens Next: Navigating the 2026 Changes and Beyond

The next 18 months will determine whether these policy changes alleviate or exacerbate America's student debt crisis. For borrowers, the key dates to watch are July 1, 2026, when new repayment plans launch and borrowing limits take effect, and January 2026, when wage garnishment resumes for defaulted borrowers. Financial advisors recommend that employees immediately inquire with their HR departments about student loan matching options, as employer adoption is voluntary and implementation timelines vary. Borrowers should also use the Federal Student Aid Loan Simulator to compare repayment options as the SAVE plan phases out.

For employers, the decision to offer student loan matching represents both a competitive advantage in talent acquisition and a strategic investment in workforce financial wellness. "Our clients who are evaluating student loan retirement matching can see value in Candidly's independent reporting, which gives them the visibility, confidence, and support they need to offer this powerful benefit," says Lee McAdoo, Managing Director at Schwab Retirement Plan Services. As student loan debt continues to influence career decisions and retirement readiness, these matching programs may become expected benefits rather than innovative perks.

The Bottom Line: Key Points for Investors and Borrowers

First, the SECURE 2.0 student loan match creates a genuine opportunity to simultaneously reduce debt and build retirement savings—if your employer offers it. Second, the 2026 federal loan changes will make graduate education more expensive for many while introducing new repayment options. Third, student debt significantly impacts investment behavior, with debt holders more likely to avoid long-term investing. Fourth, financial institutions are developing solutions to simplify employer implementation of matching programs. Finally, with 12 million borrowers in delinquency or default, the need for sustainable solutions has never been more urgent. As policy changes and financial innovation converge, the traditional trade-off between student loan repayment and retirement saving may finally be breaking down.