The investing world received crucial clarity this weekend as Warren Buffett used Berkshire Hathaway's annual meeting to confirm that successor Greg Abel will have final say over the conglomerate's massive investment portfolio. In a series of candid revelations that spanned succession planning, artificial intelligence risks, and potential new investments, the 93-year-old Oracle of Omaha provided investors with the most detailed picture yet of Berkshire's future beyond his legendary leadership.

Buffett's Succession Blueprint: Greg Abel Takes the Investment Reins

For years, investors have speculated about who would control Berkshire Hathaway's $362 billion equity portfolio when Warren Buffett eventually steps down. That question was definitively answered on Saturday when Buffett told thousands of shareholders gathered in Omaha that Greg Abel, his designated successor, would have "entirely" responsibility for capital allocation decisions.

"I would leave the capital allocation to Greg and he understands businesses extremely well," Buffett declared at the annual meeting. "If you understand businesses, you'll understand common stocks." This marks the clearest articulation to date of how Berkshire's investment decisions will be handled post-Buffett, settling debates about whether portfolio managers Todd Combs and Ted Weschler might share those responsibilities.

The succession plan reflects Berkshire's enormous scale and the complexity of managing its growing assets. "The sums have grown so large at Berkshire, and we do not want to try and have 200 people around that are managing a billion each," Buffett explained. "It just doesn't work." With Berkshire's cash hoard reaching $189 billion and its equity portfolio worth more than most countries' GDPs, Buffett emphasized that strategic thinking about "very big things" requires centralized leadership.

Abel, 61, has been with Berkshire for 25 years and currently oversees all non-insurance operations, including energy, railroad, and retail businesses. His designation as Buffett's successor was initially revealed in 2021 when Charlie Munger inadvertently mentioned it during that year's annual meeting. Since then, Abel has gradually taken on more responsibilities, with Buffett noting that "the number of calls I get from managers is essentially awfully close to zero and Greg is handling those."

From AI Warnings to Canadian Hints: The 2024 Annual Meeting Unfolds

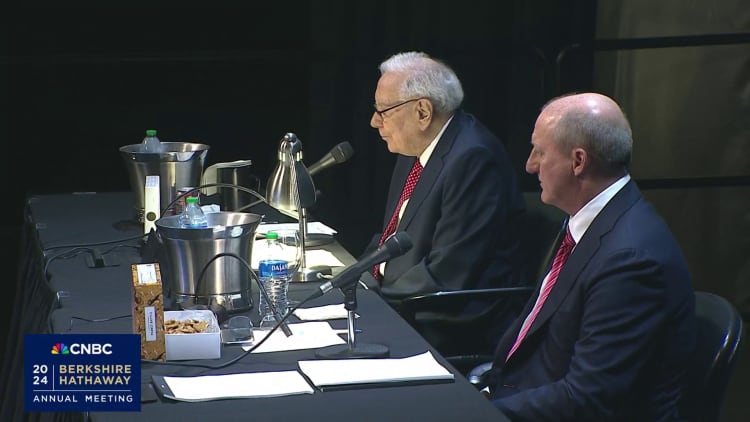

The 2024 Berkshire Hathaway annual meeting, the first without Charlie Munger since his passing in November, unfolded as a multifaceted event that addressed both immediate concerns and long-term strategy. The meeting began with a tribute to Munger, whom Buffett described as "the best person to talk to about managing money," setting a tone that acknowledged the end of one era while preparing for the next.

Buffett's most startling comments came when addressing artificial intelligence, a topic he approached with both caution and concern. "We let a genie out of the bottle when we developed nuclear weapons," he told shareholders. "AI is somewhat similar — it's part way out of the bottle." The billionaire investor revealed that his image and voice had been replicated by AI tools so convincingly that they could have fooled his own family, leading him to predict that AI-powered scams would become "the growth industry of all time."

Despite these warnings, Abel indicated that Berkshire has begun employing AI in its operations to improve efficiency. "At times it displaces the labor, but then hopefully, there's other opportunities," he said, though he provided few details about specific implementations.

In a notable shift from his recent focus on U.S. investments, Buffett revealed that Berkshire is exploring opportunities north of the border. "We do not feel uncomfortable in any shape or form putting our money into Canada," he stated. "In fact, we're actually looking at one thing now." While he didn't identify the specific company or whether it was public or private, Buffett noted that Canada's similar business environment and major economy made it an attractive market for Berkshire's capabilities.

Why This Transition Matters for Berkshire's $865 Billion Empire

The clarity around succession comes at a critical moment for Berkshire Hathaway, which has grown into an $865 billion conglomerate spanning insurance, energy, transportation, manufacturing, and retail. Investors and analysts have long questioned whether the company's unique culture—characterized by long-term thinking, decentralized operations, and aversion to dividends—could survive beyond its iconic leader.

According to Berkshire director Ronald Olson, who spoke ahead of the meeting, those concerns may be overstated. "Greg understands the culture and he will honour that," Olson said. "Greg doesn't think of himself as Warren Buffett, but I have no doubt seeing Greg running [Berkshire] the same way."

Abel's management style differs from Buffett's in meaningful ways. Executives who work with him describe a detail-oriented leader who scrutinizes financial metrics more closely than his predecessor. Adrienne Perry, chief revenue officer at Berkshire-owned jeweler Borsheims, noted that "Greg looks at our inventory levels more than Warren did. He will sometimes circle it and be like 'Oh, that looks high.'" Dan Sheridan, CEO of Brooks Running, added that "if there are warts on your balance sheet, he's going to find them."

Buffett himself acknowledged this difference, stating that "Greg will do something about it and Charlie and I wouldn't have" when it comes to addressing underperforming operations. This suggests that while Abel will preserve Berkshire's core philosophy, investors should expect more active operational oversight and financial discipline.

Where Berkshire Stands: Record Cash, AI Concerns, and Apple Moves

Beyond succession planning, the annual meeting revealed several key developments in Berkshire's current position and strategy. The company's massive cash pile, which has been a subject of much discussion, reached $189 billion at the end of March—up from $167.6 billion at the end of 2023. This growth reflects both strong operating earnings and Buffett's continued difficulty finding attractively priced acquisition opportunities.

In a significant portfolio adjustment, Berkshire reduced its position in Apple by approximately 13% during the first quarter. While Buffett didn't elaborate extensively on this move during the meeting, it represents one of the company's most substantial portfolio changes in recent years, given that Apple has been Berkshire's largest public stock holding.

Buffett's AI warnings align with concerns expressed by other financial leaders. JPMorgan Chase CEO Jamie Dimon recently wrote in his annual shareholder letter that while AI's full effects remain unknown, "we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years." Dimon also acknowledged the risks, noting that "bad actors [are] using AI to try to infiltrate companies' systems to steal money and intellectual property."

The broader investment community appears to share these concerns. A survey of CEOs at the Yale CEO Summit last summer found that 42% believed AI has the potential to "destroy humanity" within five to ten years, according to Yale professor Jeffrey Sonnenfeld.

The Abel Era: What Investors Can Expect from Berkshire's New Leadership

As the transition to new leadership progresses, investors should expect several key changes in how Berkshire operates. First, while Abel will preserve the company's core investment philosophy, his background in energy and operations suggests he may bring different perspectives to capital allocation decisions. His expertise in regulated industries and infrastructure could influence future acquisitions.

Second, Abel's more hands-on management style may lead to greater operational efficiency across Berkshire's diverse subsidiaries. Executives have already noted his attention to inventory levels, cash flows, and capital expenditure metrics—areas where Buffett traditionally granted more autonomy to subsidiary managers.

Third, the formalization of Abel's investment authority provides clarity that should reduce uncertainty among shareholders. With Buffett stating that "the chief executive should be somebody that can weigh buying businesses, buying stocks, doing all kinds of things that might come up at a time when nobody else is willing to move," investors now understand that Berkshire will maintain its centralized decision-making structure.

Finally, Buffett's comments about timing—"you don't have too long to wait on that" when discussing the leadership transition, coupled with his joke about not signing four-year employment contracts—suggest that the change may occur sooner rather than later, despite his assertion that he feels fine.

Key Takeaways from Buffett's Most Revealing Annual Meeting

The 2024 Berkshire Hathaway annual meeting provided unprecedented clarity about the company's future while addressing pressing contemporary issues. Key takeaways for investors include:

- Definitive Succession Plan: Greg Abel will have complete authority over Berkshire's investment decisions, ending years of speculation about how the portfolio would be managed post-Buffett.

- AI as Double-Edged Sword: While Berkshire is implementing AI for efficiency gains, Buffett views the technology with serious concern, particularly regarding its potential for enabling sophisticated scams.

- International Expansion: Berkshire's exploration of Canadian investment opportunities signals a potential broadening of geographic focus beyond its traditional U.S.-centric approach.

- Cultural Continuity: Despite leadership changes, Berkshire's distinctive culture of long-term thinking and decentralized operations is expected to endure under Abel's stewardship.

- Operational Discipline: Abel's management style brings greater financial scrutiny to Berkshire's subsidiaries, potentially improving efficiency across the conglomerate.

As Warren Buffett approaches his 94th birthday in August, this year's annual meeting may be remembered as the moment when the Oracle of Omaha began formally passing the torch. For investors who have followed Buffett's career for decades, the transition represents both the end of an era and the beginning of a new chapter for one of the world's most successful investment organizations. With Greg Abel positioned to continue Berkshire's unique approach to capital allocation while introducing his own operational expertise, the company appears well-prepared for its next phase of growth and value creation.