Saving money can seem challenging, especially if you're working with a limited budget. However, with the right strategies, it's possible to build your savings quickly, even on a low income. Here are some practical tips on how to save money fast on a low income—because every penny saved is a penny earned!

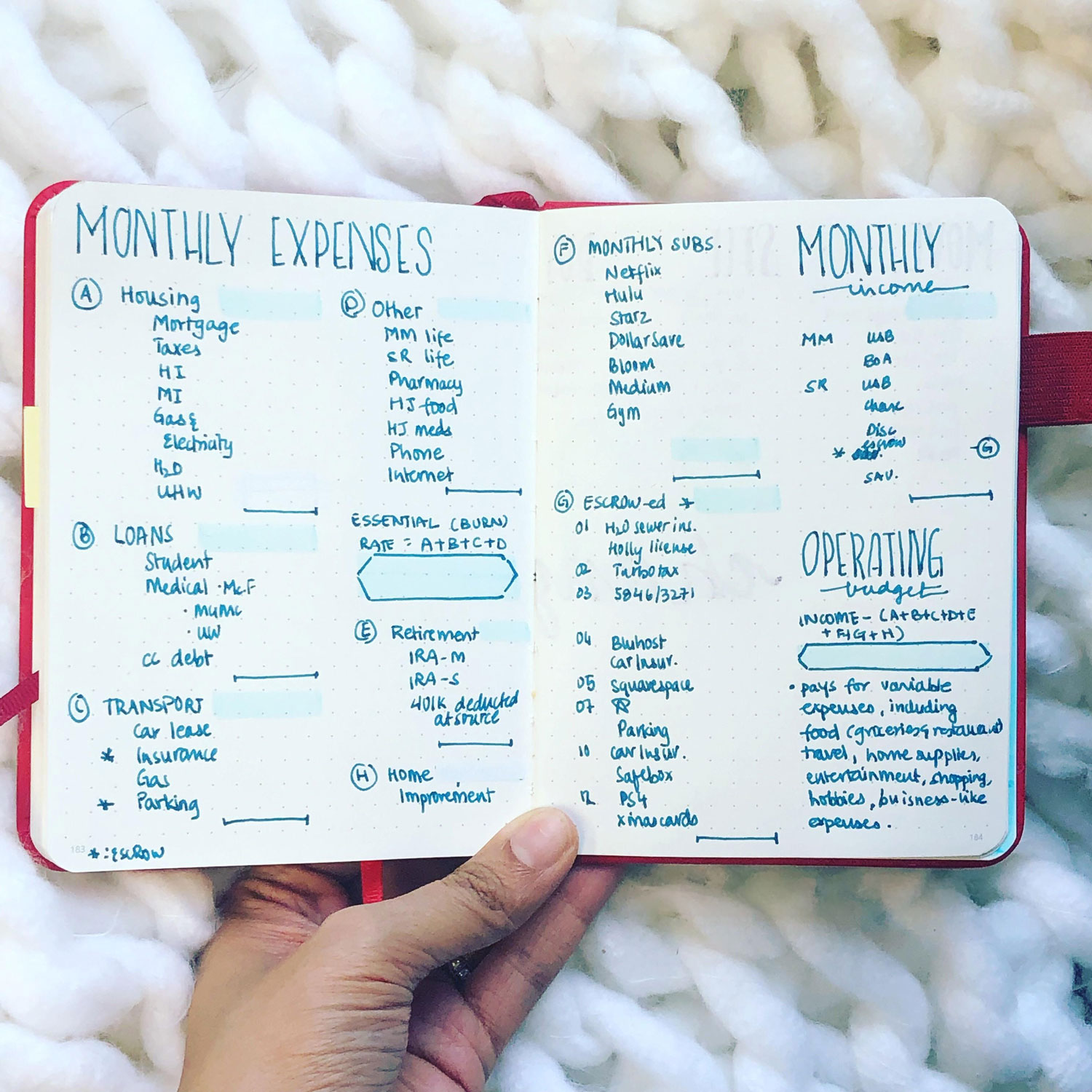

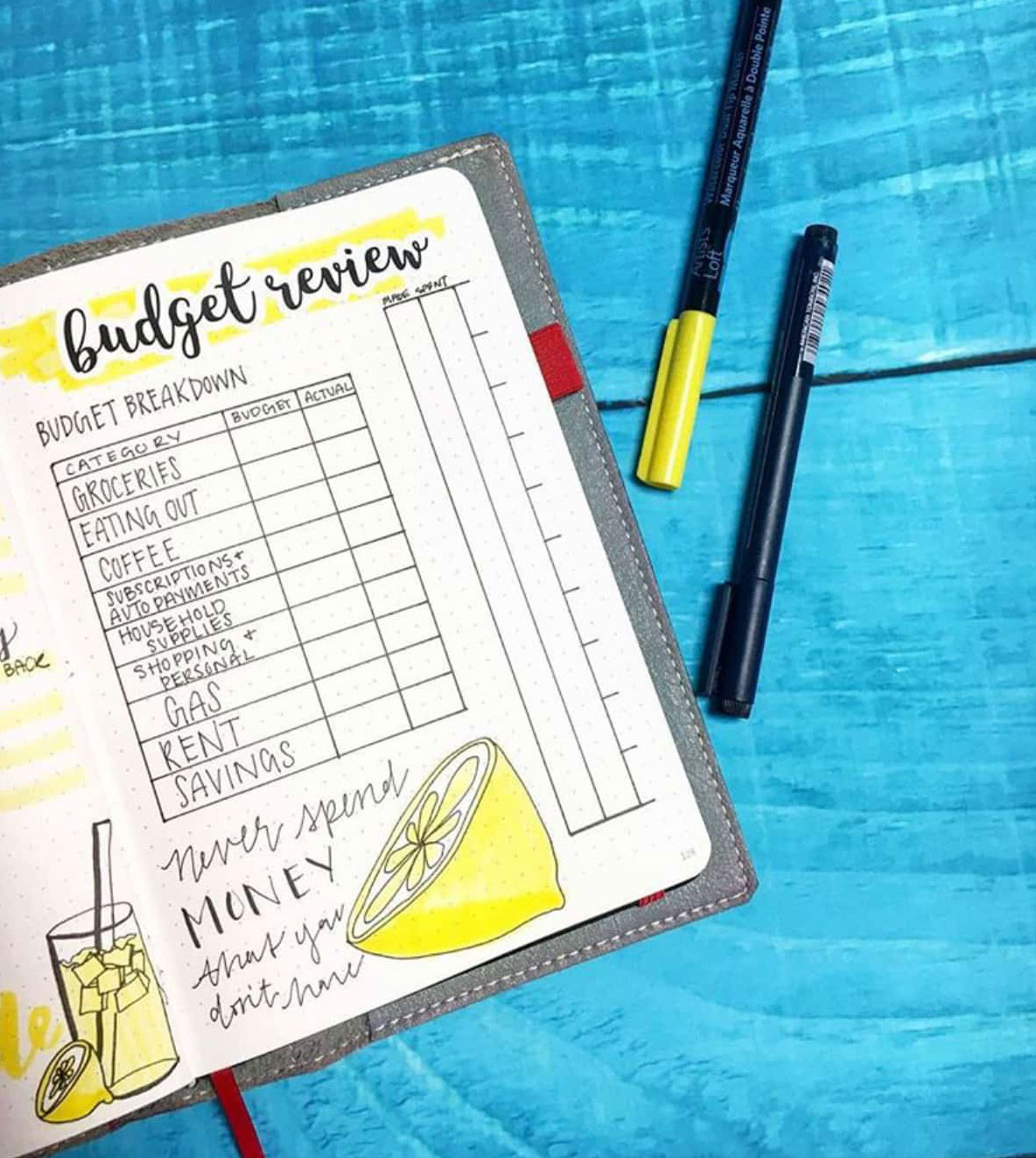

Create A Budget

The first step to saving money is knowing where your money goes. Create a budget that tracks your income and expenses. List all your sources of income and categorize your expenses. This will give you a clear picture of your financial situation and help you identify areas where you can cut costs.

Cut Unnecessary Expenses

Look closely at your spending habits. Are there any subscriptions or memberships you don't use? Cancel them. Are you spending too much on eating out or entertainment? Try cooking at home and finding free or low-cost activities. Every dollar saved adds up quickly.

Use Coupons And Discounts

Take advantage of coupons and discounts whenever possible. There are many apps and websites that offer deals on groceries, clothing, and other essentials. Using these tools can help you save money on items you already buy, making it easier to stick to your budget.

Cook At Home

Eating out can be expensive, especially if you do it frequently. Cooking at home is a great way to save money and eat healthier. Plan your meals, make a shopping list, and stick to it. You’ll be surprised at how much you can save by simply preparing your own meals.

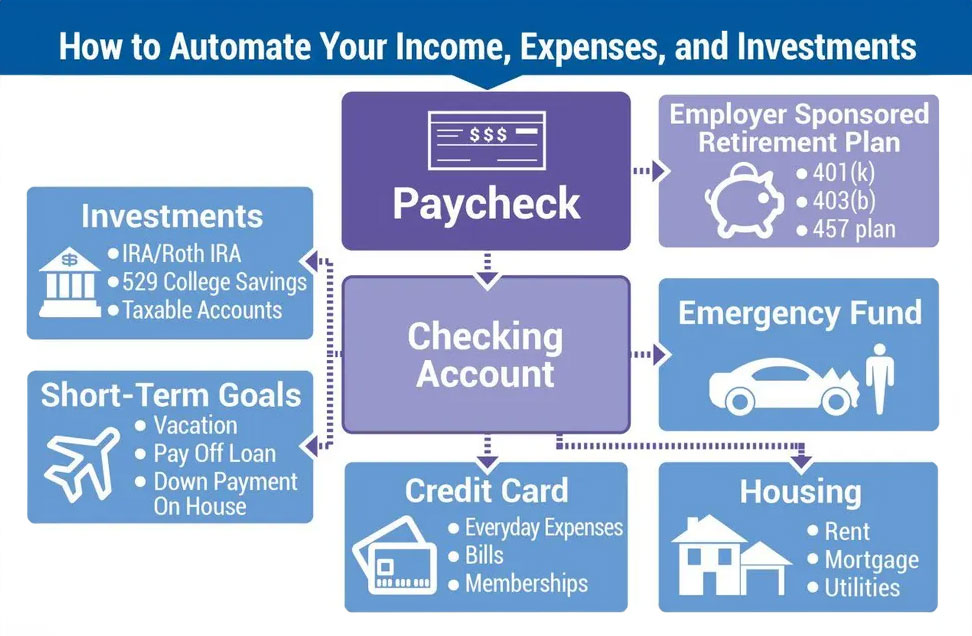

Automate Your Savings

Set up automatic transfers from your checking account to your savings account. Even if it's just a small amount each month, automating your savings ensures you’re consistently putting money aside. Over time, these small amounts will grow, helping you build your savings faster.

Find Additional Income Streams

Consider finding ways to earn extra money. This could be through freelance work, a part-time job, or selling items you no longer need. Even a few extra dollars a week can make a significant difference in your savings over time.

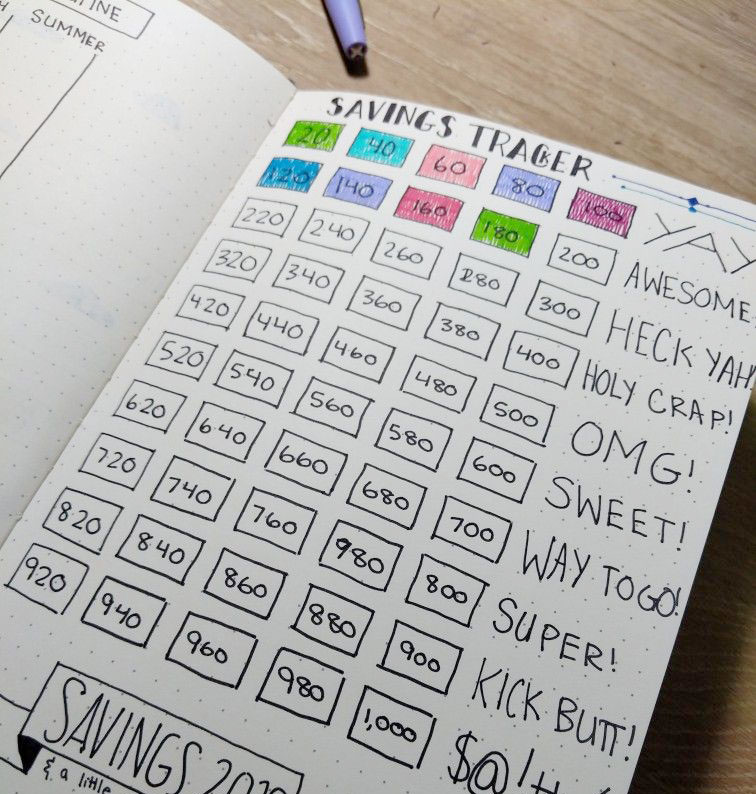

Track Your Progress

Keep track of your savings goals and celebrate your milestones. Seeing your progress can be motivating and help you stay committed to your saving efforts. Use a savings app or a simple spreadsheet to monitor your progress and adjust your budget as needed.

Avoid Debt

Avoiding debt is crucial when trying to save money on a low income. High-interest debt can eat into your savings and make it difficult to get ahead financially. If you have existing debt, focus on paying it off as quickly as possible while still setting aside some money for savings.

Seek Financial Advice

If you're struggling to save money, consider seeking advice from a financial advisor or a nonprofit credit counseling service. They can provide personalized tips and strategies to help you manage your money more effectively and reach your savings goals.

Learning how to save money fast on a low income requires discipline and smart planning. By creating a budget, cutting unnecessary expenses, using coupons, cooking at home, automating your savings, finding additional income streams, tracking your progress, avoiding debt, and seeking financial advice, you can build your savings quickly and achieve financial stability. Remember, every small step you take toward saving money can lead to significant results over time.