Long-term care insurance can provide peace of mind by covering expenses for assisted living, nursing homes, or in-home care. But a common question many consumers have is: Is long-term care insurance tax deductible? In this article, we’ll explore the tax benefits of this type of insurance, who qualifies for deductions, and how you can maximize your savings come tax season.

Understanding Long-Term Care Insurance

Long-term care insurance is designed to cover services that aren’t typically covered by health insurance, Medicare, or Medicaid. This includes costs for personal and custodial care, either in your own home or at a specialized care facility. As healthcare costs rise, having this type of insurance can be a financial lifesaver. But understanding whether premiums for long-term care insurance can be deducted is key to making informed decisions regarding your financial and tax planning..

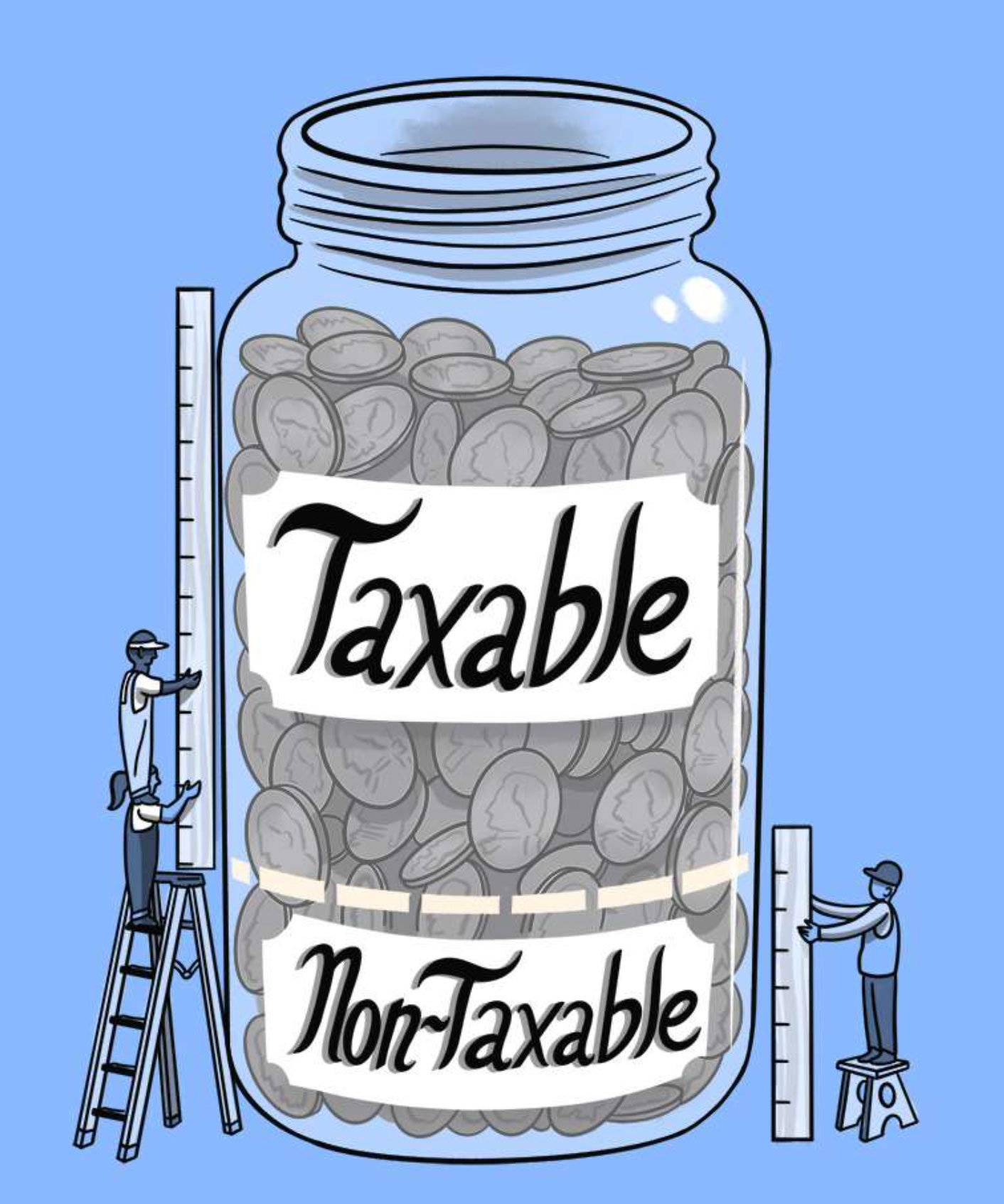

Is Long-Term Care Insurance Tax Deductible?

Yes, long-term care insurance premiums can be tax deductible, but there are specific qualifications and limits. According to the IRS, premiums can be deducted as a medical expense on your federal tax return, provided they meet certain criteria. The tax deduction is typically available if you itemize your deductions and your total medical expenses, including long-term care insurance premiums, exceed 7.5% of your adjusted gross income (AGI)..

Eligibility And Age-Based Deduction Limits

The IRS imposes age-based limits on the amount of long-term care insurance premiums you can deduct. These limits increase as you age. For example, in 2023, individuals aged 40 or younger could deduct up to $480, while those aged 71 and older could deduct up to $5,960. It’s crucial to be familiar with these limits as they can change each tax year and significantly impact the amount you can claim as a deduction..

What Qualifies As A Tax-Deductible Premium?

To be considered tax deductible, your long-term care insurance policy must meet specific standards set by the IRS. The policy must qualify as a 'tax-qualified' plan, meaning it complies with the Health Insurance Portability and Accountability Act (HIPAA). Non-qualified policies do not offer any tax-deductible benefits, so it’s important to confirm this before purchasing your insurance plan..

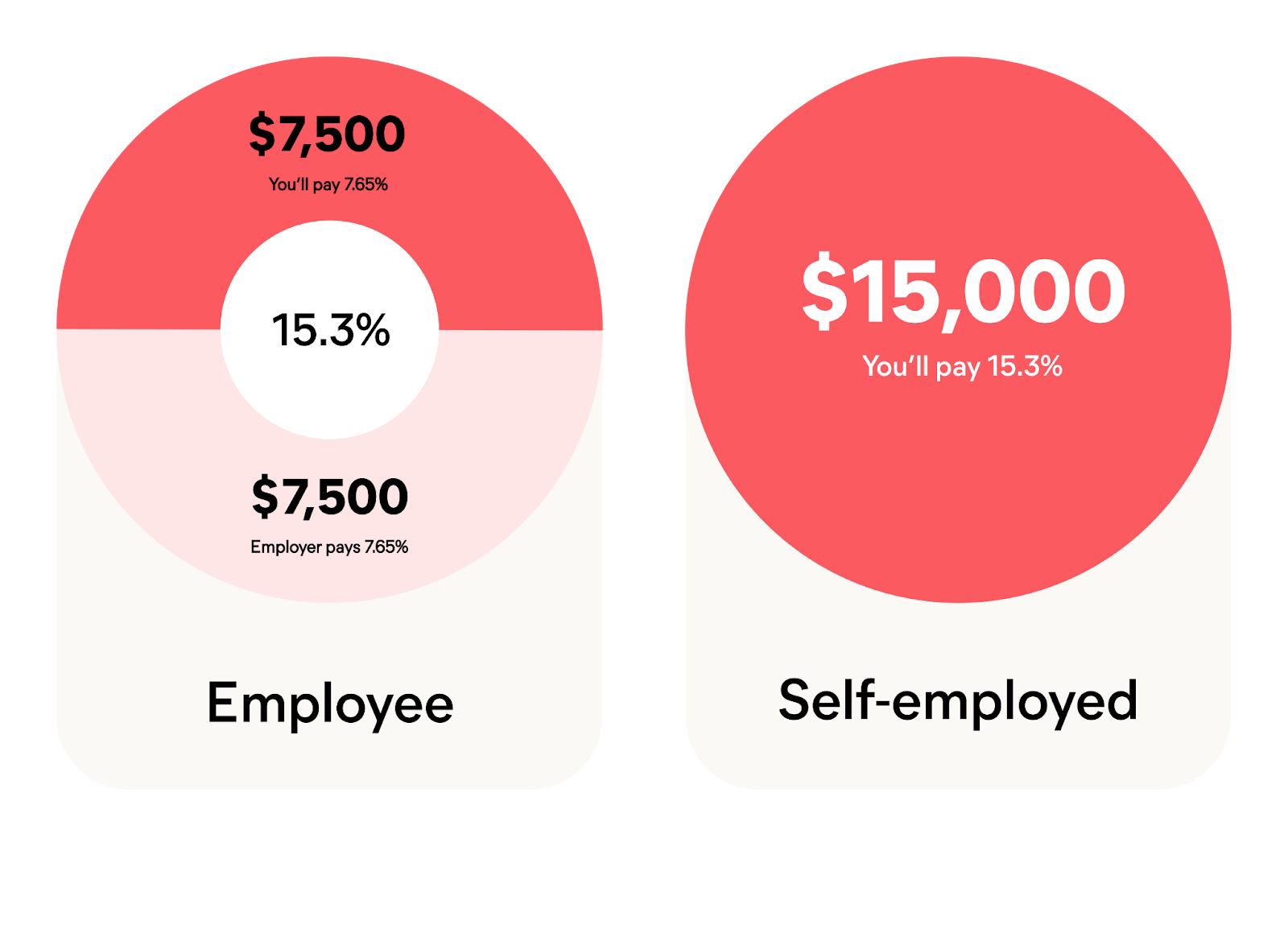

Employer And Self-Employed Deductions

If you’re self-employed, there’s good news: you may be able to deduct the premiums you pay for long-term care insurance as a business expense, even if you don’t itemize your deductions. Similarly, some employers offer long-term care insurance as part of their benefits package, and premiums paid for by your employer are generally not considered taxable income. It’s worth discussing these potential benefits with your financial advisor or employer..

Do State Taxes Impact Deductibility?

While federal tax deductions for long-term care insurance are clear, state tax laws can vary. Some states offer additional tax incentives related to long-term care insurance, including tax credits or deductions. Research your state’s tax laws or consult a tax professional to see if your premiums qualify for any state-level benefits..

Tips For Maximizing Your Tax Savings

To maximize your tax savings, keep detailed records of your long-term care insurance premiums and all medical expenses. Consider bundling other qualified medical expenses in the same tax year to ensure you exceed the 7.5% AGI threshold required for deductions. Consulting a tax professional can also help you navigate the complexities of deductions and avoid missing out on potential tax-saving opportunities..

How To Report Long-Term Care Premiums On Your Taxes

To claim a deduction, you’ll need to itemize your deductions on Schedule A of Form 1040. Include your long-term care insurance premiums, along with other qualifying medical expenses, to calculate your total deductions. Remember, these deductions are only applicable if you exceed the standard deduction, so factor this into your tax planning strategy..

Common Misconceptions About Tax Deductions For LTCI

One common misconception is that all long-term care insurance premiums are entirely tax deductible. As discussed earlier, several conditions such as AGI limits, age-based caps, and whether the policy is tax-qualified must be met. Another myth is that policies purchased through work don’t qualify for perks—while the premiums paid by your employer are not deductible for you, they may still provide tax benefits in other forms..

Long-term care insurance is a valuable tool for protecting against the high costs of extended care. While the answer to 'Is long-term care insurance tax deductible?' is often 'yes,' the nuances of eligibility criteria, deduction limits, and policy qualifications mean it’s crucial to stay informed. By understanding the tax implications and planning strategically, you can make the most of your long-term care insurance and reduce your tax burden. Always consult with a tax professional to ensure compliance and to maximize your potential benefits.