Retirement can be an exciting time, but many seniors wonder how their lifestyle will change with the loss of a regular income. Even though you're retired, you'll still need to account for expenses such as rent or a mortgage, utilities, housing maintenance, and meals. Fortunately, with a bit of planning, you'll still be able to live comfortably on a tighter budget.

Consider Your Sources of Income

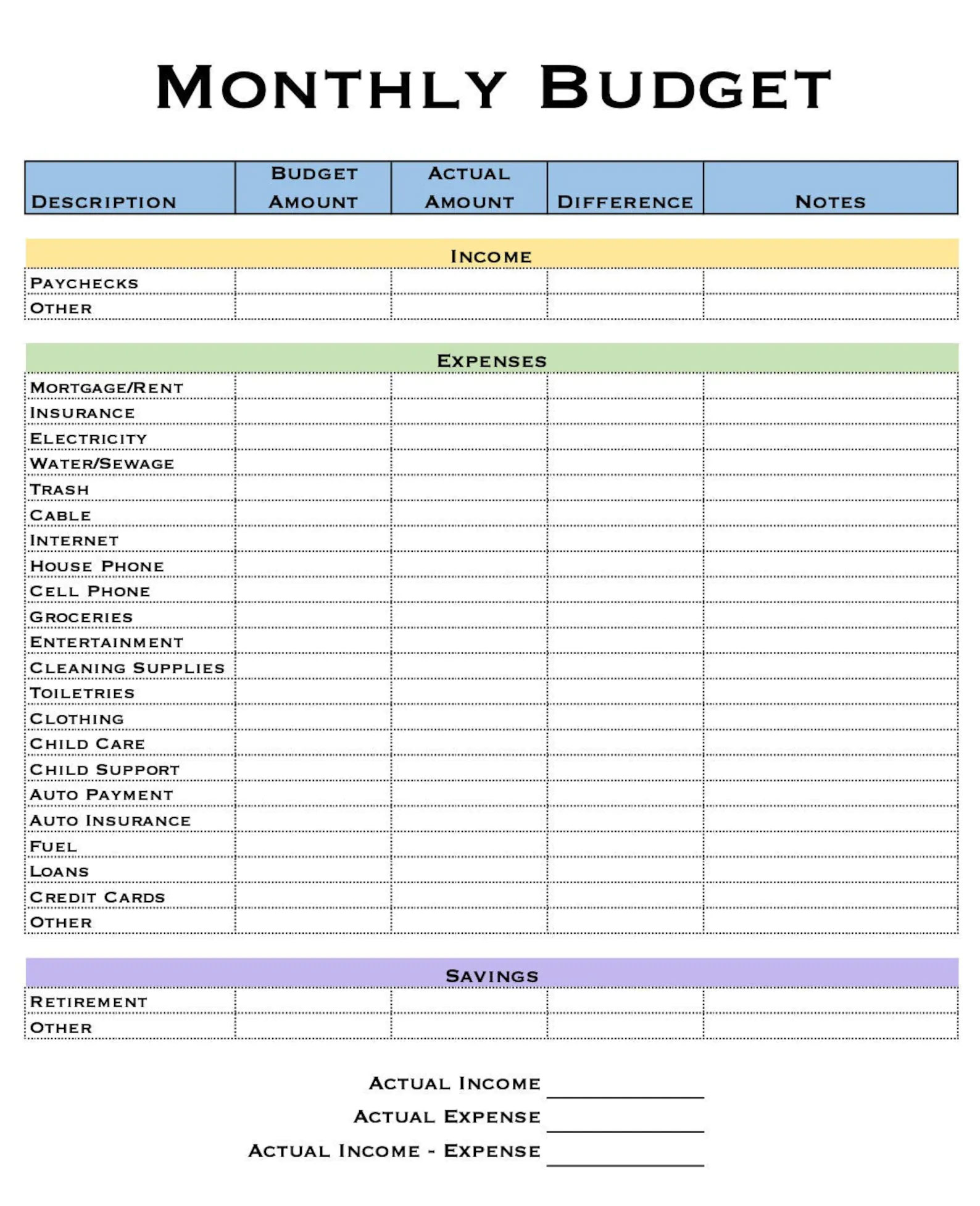

Even if you no longer have a regular job, you may still have a few sources of income that can be used to support you throughout retirement. If you've worked for long enough, you'll likely receive Social Security benefits that pay a portion of your former income. You may also have retirement accounts, such as a 401(k) or IRA, which you can withdraw funds from once you reach a certain age. Other sources of income might include money from a part-time job, consulting, or monthly payments from renting your property to tenants. Once you've added up all income sources, you'll have a better idea of how much can be spent on expenses.

Make a Detailed List of Expenses

Add up everything you expect to spend on necessities such as housing, food, insurance, transportation, and health care. If your expenses are higher than your retirement income, consider what you're able and willing to cut back on. For example, you can lower your food costs by skipping restaurants and eating at home instead. You might be able to lower transportation costs if you're not driving to work every day. If you have a large credit card balance, focus on paying it off to avoid hefty interest charges, which will make your budget a little easier to work with.