Are you exploring ways to secure your future income during retirement? If so, you may have come across the term 'fixed annuity.' But what is a fixed annuity, and how does it work? Understanding the basics of this financial product can help you make informed decisions about your retirement plan. In this article, we delve into the key features, benefits, downsides, and types of fixed annuities so you can decide whether this option aligns with your financial goals.

What Is a Fixed Annuity?

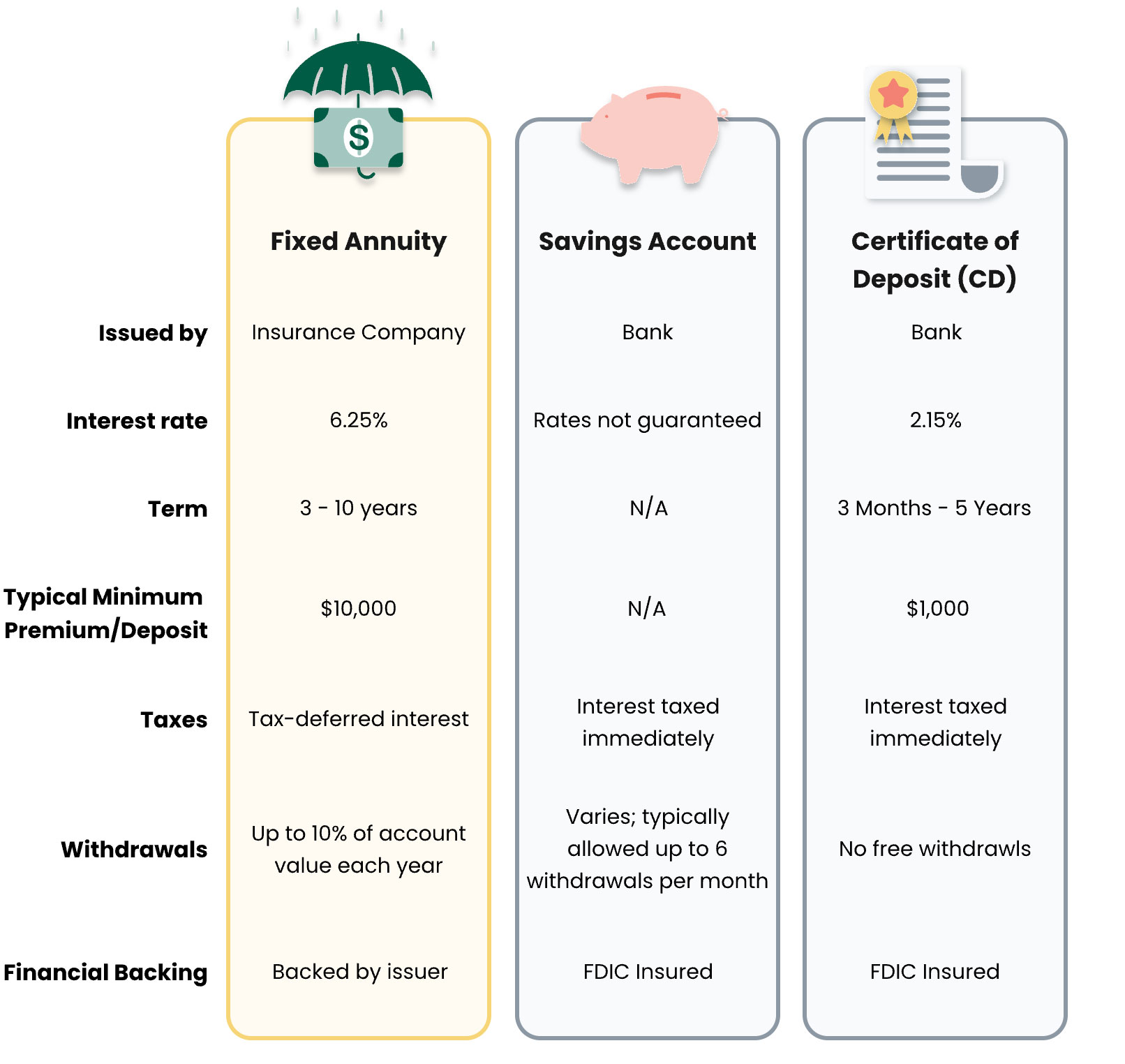

A fixed annuity is a financial product offered by insurance companies that provides regular, guaranteed payments over a specific period or for life. In exchange for a lump sum or series of payments, the insurer promises a fixed interest rate and a steady income stream for a set duration. Fixed annuities are designed to offer financial stability and predictability, making them popular among retirees who value consistent income.

How Does A Fixed Annuity Work?

When you purchase a fixed annuity, you either pay a single premium or make multiple payments over time. These funds are invested by the insurance company, and in return, you receive guaranteed periodic payments. The interest rate is typically locked in at the start, ensuring that your income does not fluctuate with market volatility. This makes fixed annuities particularly appealing to conservative investors who want predictable returns.

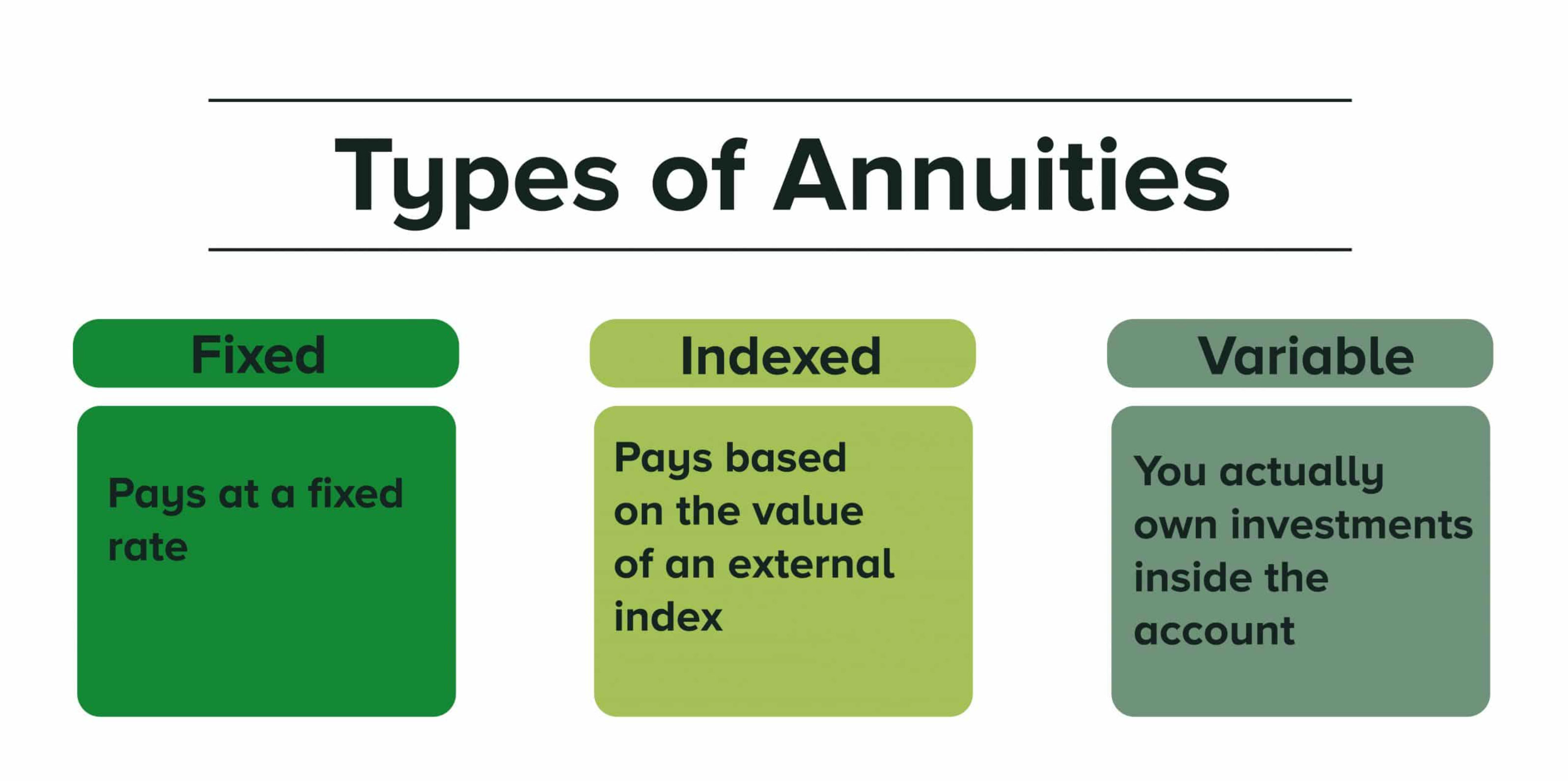

Types Of Fixed Annuities

There are several types of fixed annuities, including immediate and deferred annuities. An immediate fixed annuity begins payments right after the initial investment, often used by retirees looking for income right away. A deferred fixed annuity, on the other hand, allows your investment to grow tax-deferred until you start taking withdrawals later. Other variations include multi-year guaranteed annuities (MYGAs), which offer fixed interest rates over multiple years.

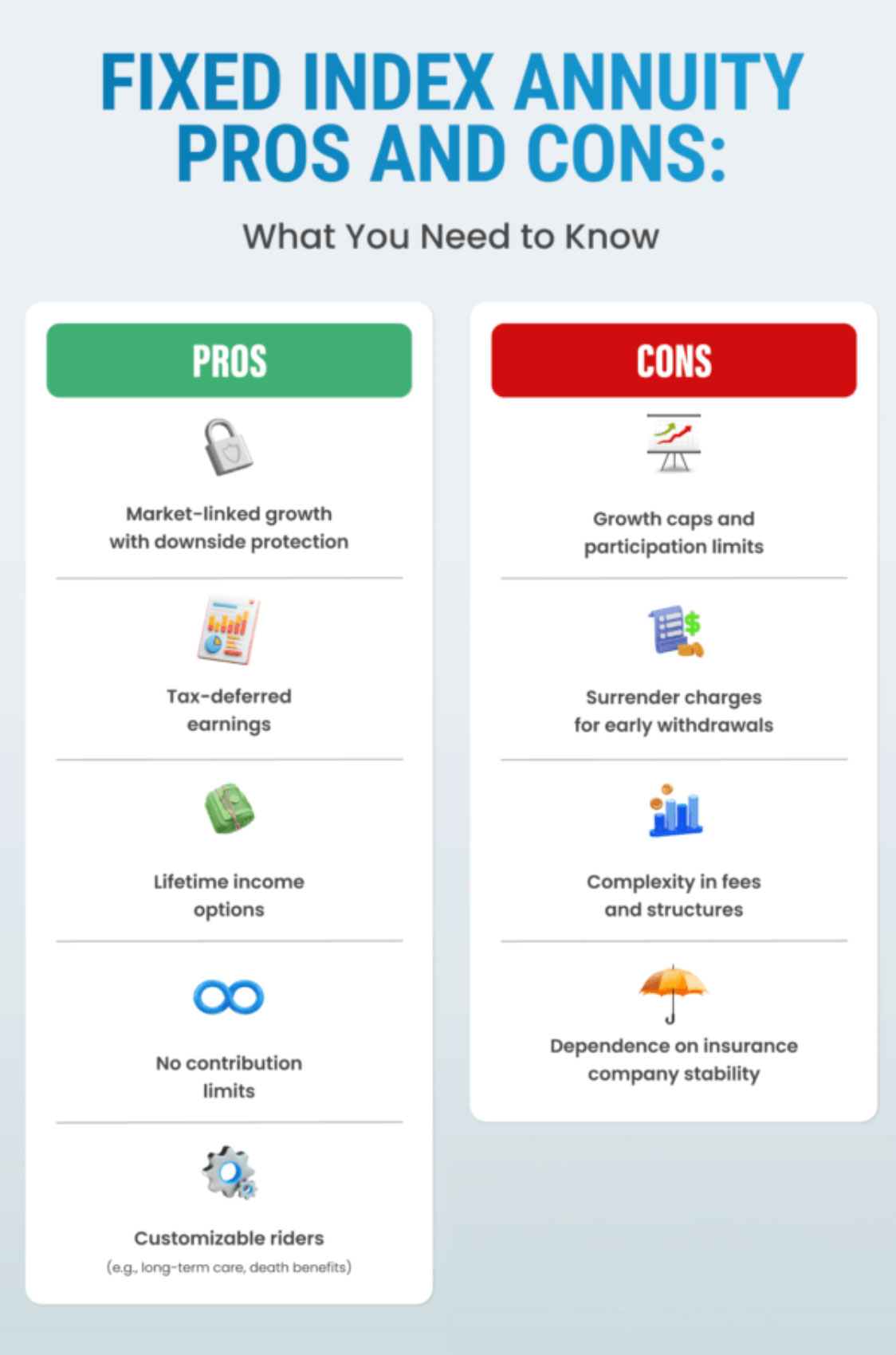

Benefits Of A Fixed Annuity

One of the main benefits of a fixed annuity is the financial security it provides. With guaranteed interest rates and predictable payments, contract holders enjoy peace of mind knowing their income won't be affected by market downturns. In addition, fixed annuities grow on a tax-deferred basis, allowing your investment to compound without immediate tax liability. This makes them appealing to individuals looking to grow their retirement savings steadily.

Tax Advantages Of Fixed Annuities

Fixed annuities offer special tax benefits that can help you optimize your retirement income. Earnings within a fixed annuity grow tax-deferred, meaning you won’t pay taxes on the interest until you begin withdrawals. This can result in greater long-term growth compared to taxable investments. However, it's essential to know that early withdrawals may incur taxes and penalties, especially if taken before the age of 59½.

Drawbacks To Consider

While fixed annuities offer many advantages, they also come with limitations. One potential drawback is limited liquidity – accessing funds early may involve surrender charges and tax penalties. Additionally, fixed annuities may offer lower returns compared to riskier investment options like stocks. It’s important to weigh these factors and consider whether the guaranteed income justifies giving up potential market gains.

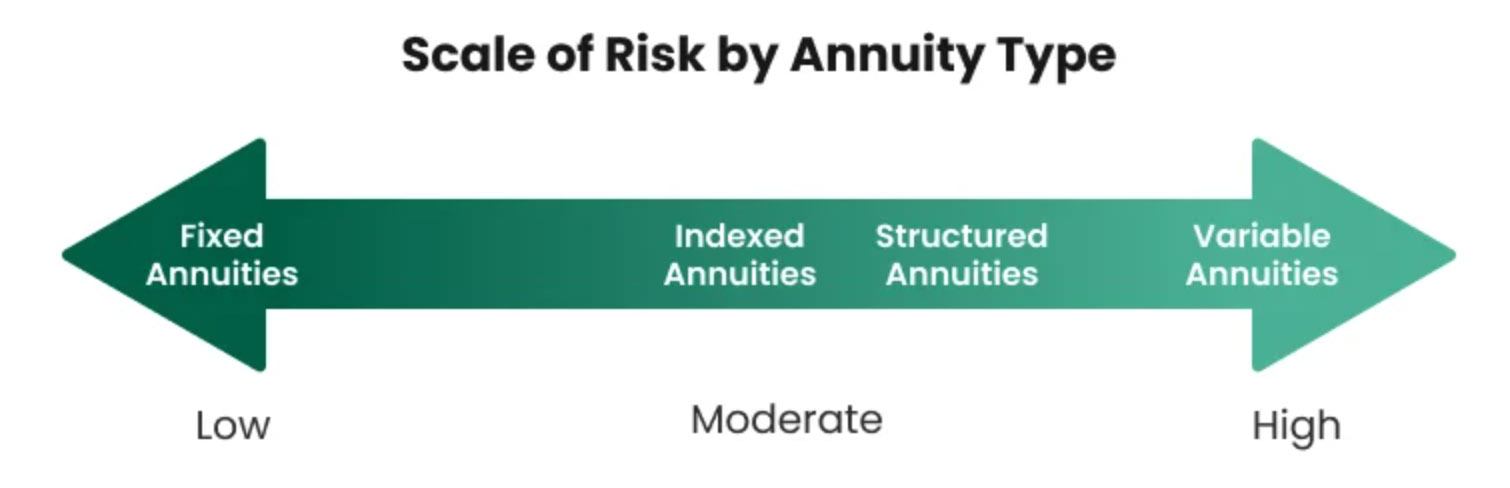

Comparing Fixed Annuities To Other Annuities

Understanding how fixed annuities differ from variable and indexed annuities can help you make an informed choice. Unlike fixed annuities, variable annuities invest in a portfolio of funds, and returns may fluctuate based on market performance. Indexed annuities offer a middle ground by linking returns to a stock market index, with some downside protection. Fixed annuities stand out for their stable, guaranteed income stream, ideal for risk-averse individuals.

Who Should Consider A Fixed Annuity?

Fixed annuities are best suited for individuals seeking a stable source of income during retirement. They are particularly beneficial for conservative investors, retirees looking to supplement Social Security or pension income, and those who want to ensure predictable cash flow. If you value financial certainty and prefer to avoid market volatility, a fixed annuity might be a good addition to your retirement portfolio.

How To Purchase A Fixed Annuity

To purchase a fixed annuity, start by evaluating your financial goals and consulting a licensed financial advisor. Research various insurance providers, compare interest rates, and review contract terms carefully. Be mindful of surrender periods, fees, and options for inflation protection. Working with a trustworthy advisor ensures you select a product tailored to your long-term needs and objectives.

Fixed annuities offer a reliable, low-risk way to generate income in retirement. With guaranteed payments, tax-deferred growth, and protection from market volatility, they can be a valuable part of a well-rounded retirement plan. However, it's important to understand the limitations and consult with a financial advisor to ensure they align with your goals. By asking 'What Is A Fixed Annuity?' and understanding the answer, you're one step closer to making smarter financial decisions for your future.