What Is An Indexed Annuity?

Ready to secure your financial future without playing a game of retirement roulette? An indexed annuity could be the golden ticket in your retirement planning portfolio. Offered by insurance companies, this special savings vehicle grows based on the performance of stock market indexes, like the S&P 500. Essentially, your potential earnings mirror the ups and downs of these indexes, offering a strategic way to boost your nest egg by staying in tune with market trends—without putting all your eggs in one basket.

How Does It Work?

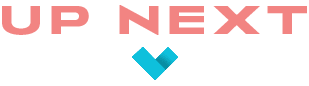

This type of annuity lets your savings grow alongside the stock market, giving you a portion of the market's gains while cushioning you against losses with a guaranteed minimum return. Even if the market takes a dip, your principal investment is protected. However, there's a cap on how much you can earn; if the market soars, your gains from the annuity are limited to a predetermined maximum. Also, pulling your money out early might lead to penalties, similar to the consequences of an early withdrawal from a traditional savings account.

Why Consider One?

Indexed annuities appeal to those cautious about the stock market's roller coaster, providing a more secure way to grow retirement savings while still offering the potential for higher returns compared to traditional savings avenues. They come with the added benefit of tax-deferred growth and the option to turn your annuity into a regular income during retirement, ensuring your financial planning doesn't retire before you do.

Things To Think About

The path to choosing an indexed annuity can seem tangled with various fees, caps on earnings, and restrictions on withdrawals. While they present a safer investment route than going directly into the stock market, they might yield lower returns over time compared to more aggressive investment strategies.

How To Choose The Right Indexed Annuity

Selecting the right indexed annuity involves weighing the insurance company's credibility, the annuity's specific terms like cap rates and participation rates, and understanding the surrender charges. A comparison of these details across different annuities, alongside advice from a financial advisor, can guide you toward the best fit for your retirement planning goals.

Indexed Annuities VS. Other Retirement Savings Options

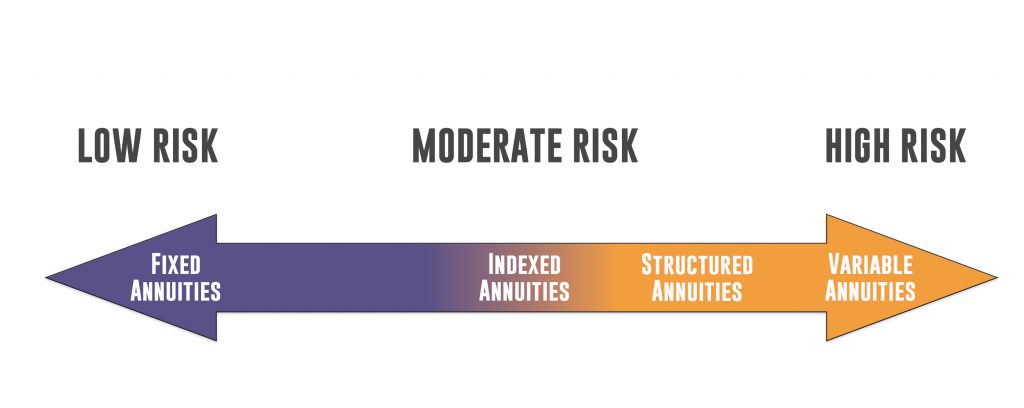

Balancing indexed annuities against other retirement savings options is crucial for a well-rounded retirement strategy. While they offer a middle ground between potential growth and risk protection, direct investments in the stock market or mutual funds might promise higher growth at a higher risk. On the other hand, fixed annuities provide stable but typically lower returns. Matching your financial aspirations, risk tolerance, and retirement timeline with the right mix of investments can secure a comfortable and prosperous retirement.

Navigating Your Retirement Planning With Indexed Annuities

Wrapping it up, indexed annuities stand out as a savvy choice for those aiming to mix security with growth potential in their retirement strategy. Getting to grips with how these annuities work, weighing them against other investment options, and seeking expert financial advice can lead to informed, strategic decisions that ensure a robust financial foundation for your retirement. With a clear understanding and a smart approach, you're well on your way to making your retirement years golden without relying on a financial crystal ball.