Many couples can't wait to retire together. Unfortunately, when they leave employment for good, they realize that they didn't plan ahead. What will their monthly budget look like? What if an unexpected event occurs, such as a sudden illness? How do they stay occupied?

Couples need to plan ahead even if they have their pensions sorted out. Otherwise, they'll waste time that they could have spent enjoying themselves.

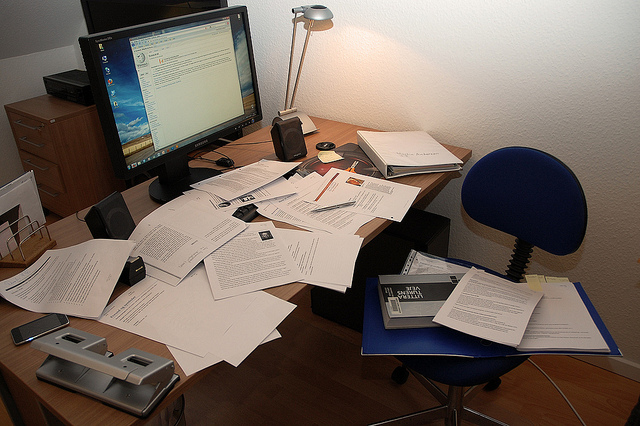

Organize Your Finances

Lay out your finances like you're getting ready to sign a prenup. If both individuals have retirement funds, estimate your monthly budget. Account for other government benefits, such as Medicare and Social Security. Discuss hobbies, investments, commissions, and other potential income sources.

Additionally, remember that you don't have to retire together. If you retire at different times, figure out how you'll support both parties during the gap. Talk about the income and other benefits, such as health insurance, that you'll have in the meantime.

Define Your Expectations

Decide what you and your spouse want to do in retirement. If you want to travel, you'll need to ensure that you'll have money and accommodations. Make sure that you have enough time and money for other ventures, such as hobbies and visiting relatives. Consider moving into a retirement community with fewer responsibilities.

You and your partner don't have to do everything together. Discuss your separate goals, such as traveling to different places and picking up new skills. Either way, figure out a plan so that you don't suddenly retire and have nothing to do afterward.

Whatever you decide to do, get your plan in writing so that you can refer to it later and reduce the risk of conflicts.