A living trust is a popular estate planning tool. These legal documents can help you protect your assets and ensure they’re distributed correctly after death. However, it can be easy to make mistakes in your living trust. A well-drafted trust can protect your heirs from creditors and ensure they get assets quickly. A poorly-drafted trust can lead to problems for your beneficiaries. These two tips can help you avoid the most common mistakes.

Get Professional Help

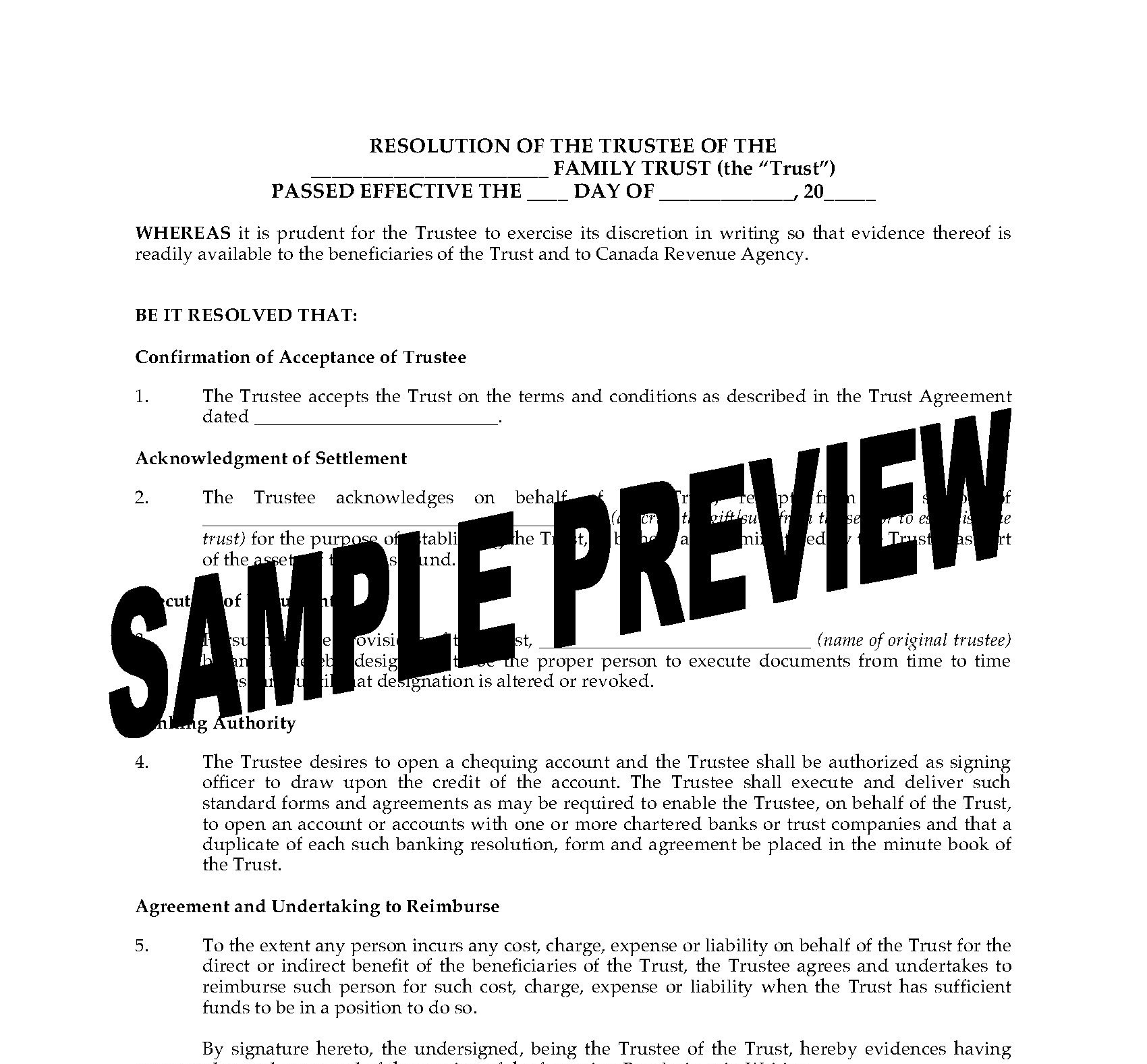

There are do-it-yourself templates for living trusts, but it's best to go to an expert. Estate planning professionals know the language to use and can make sure the document meets all legal requirements. The DIY options available are very generic, meaning they don’t take your individual circumstances into consideration. A professional will ask about your goals for the trust and build a document that meets your needs. A specialist also reminds you of the steps you need to take to complete the trust, such as transferring assets. Finally, a professional can answer questions and help you make the best decisions for your circumstances.

Review Regularly

One of the benefits of a living trust is the flexibility to make changes, and a regular review helps you get the most from the document. Look at it once a year to check that it still reflects your wishes. Major life changes, such as a new grandchild, can prompt a change to a living trust. The right edit to your trust can ensure the inheritance is protected, even when beneficiaries aren't able to manage affairs by themselves. It's also important to check for smaller changes. If you've bought or sold an asset, or need to appoint a new successor trustee, this should be reflected in the trust.