Many retirees wonder: Can I contribute to a Roth IRA after retirement? The short answer is yes, under certain conditions. Understanding how retirement income, IRS regulations, and eligibility criteria work can help you make the most of your retirement savings. Let’s explore the benefits, limitations, and strategies for contributing to a Roth IRA after you've left the workforce.

Understanding Roth IRA Contribution Rules

To answer the question, 'Can I contribute to a Roth IRA after retirement?' you need to understand the IRS rules. The primary requirement for contributing to a Roth IRA is having earned income. This includes wages, salaries, and self-employment income. If you're fully retired and no longer working in any capacity, you may not be eligible to contribute. However, if you're engaged in part-time work or run a small business, you could still qualify to contribute.

Earned Income vs. Retirement Income

Retirement income, such as pensions, Social Security, or distributions from retirement accounts, does not count as earned income under IRS guidelines. This is a critical distinction because, to continue contributing to a Roth IRA after retirement, you need earned income. For retirees with part-time jobs or freelance work, this income may meet the requirement, allowing continued Roth IRA contributions.

Age Limitations Are No Longer a Barrier

Previously, age was a limiting factor for IRA contributions. However, with the passage of the SECURE Act in 2019, there is no longer an age limit for contributing to a Roth IRA. This change opened the door for retirees who continue earning income to contribute beyond the traditional retirement age, allowing them to grow their tax-free retirement savings further.

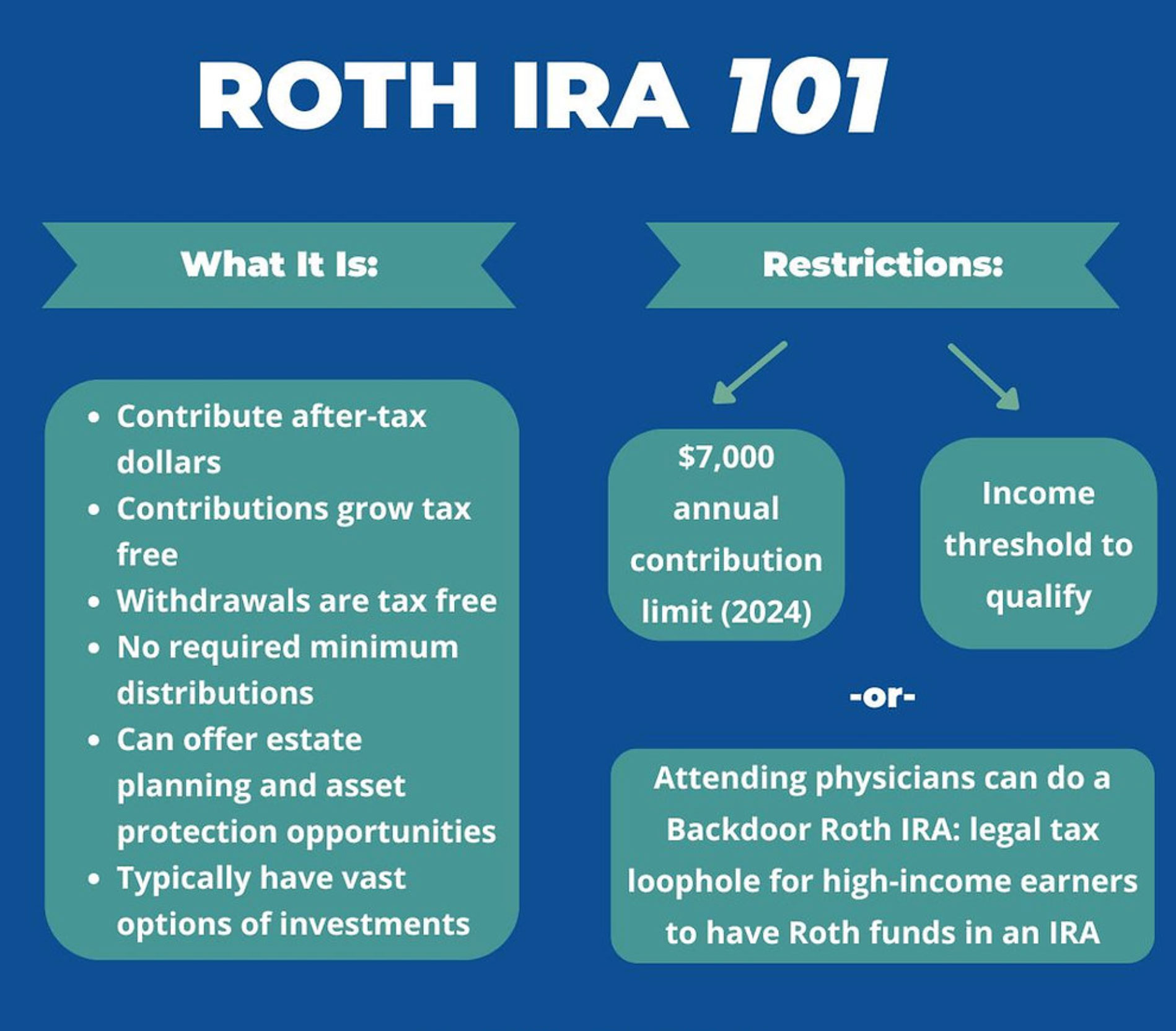

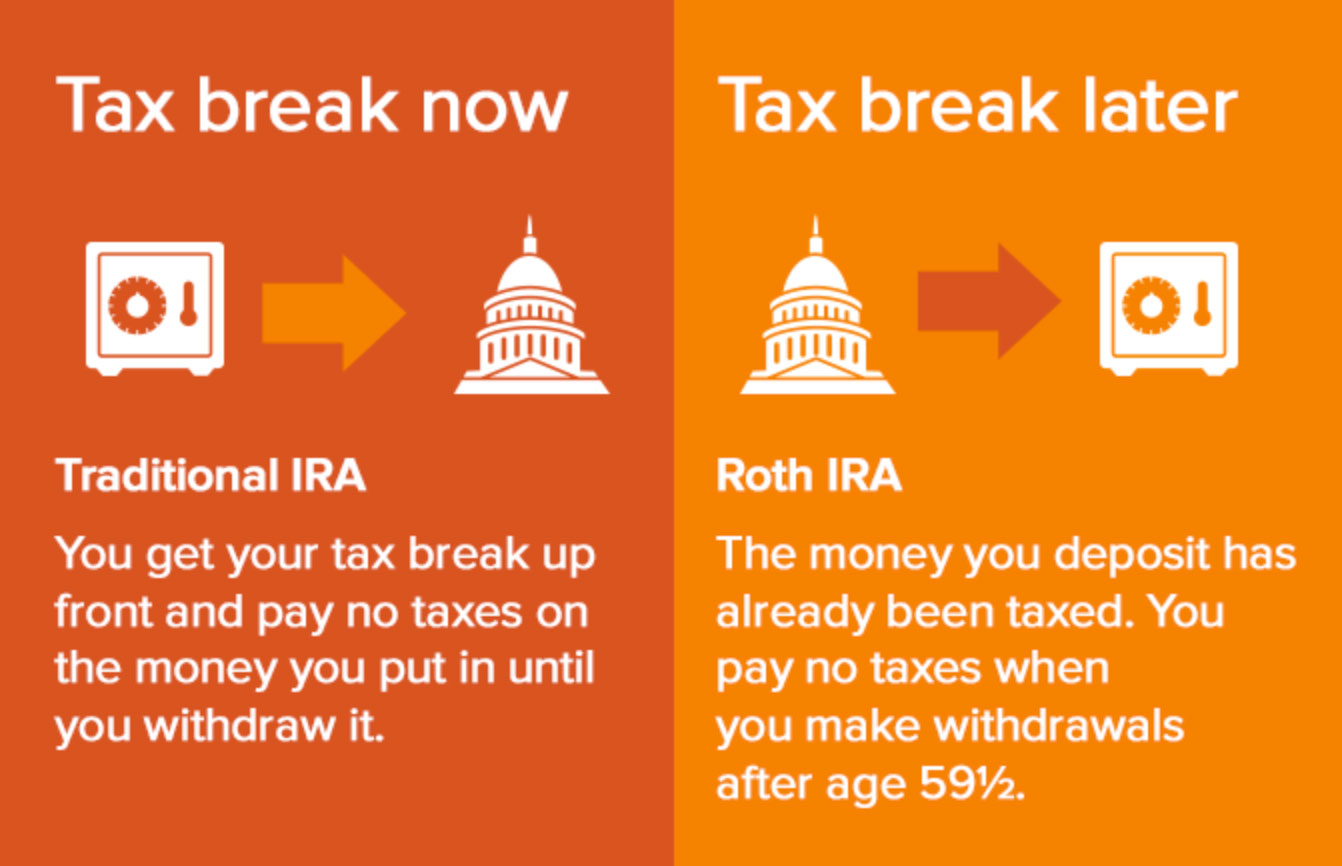

Tax Benefits of Post-Retirement Contributions

One major advantage of contributing to a Roth IRA after retirement is tax-free growth and withdrawals in retirement. Since contributions are made with after-tax dollars, qualified withdrawals—both principal and earnings—are tax-free. This can be particularly beneficial in providing tax diversity in retirement and avoiding higher tax brackets in the future.

Spousal Roth IRA Contributions After Retirement

If you are retired but your spouse still earns income, you can take advantage of a spousal Roth IRA. Under IRS guidelines, a working spouse can contribute to a Roth IRA on behalf of a non-working spouse, provided the couple files jointly and the total contributions don’t exceed the household's earned income. This is an excellent strategy for households where only one spouse is retired.

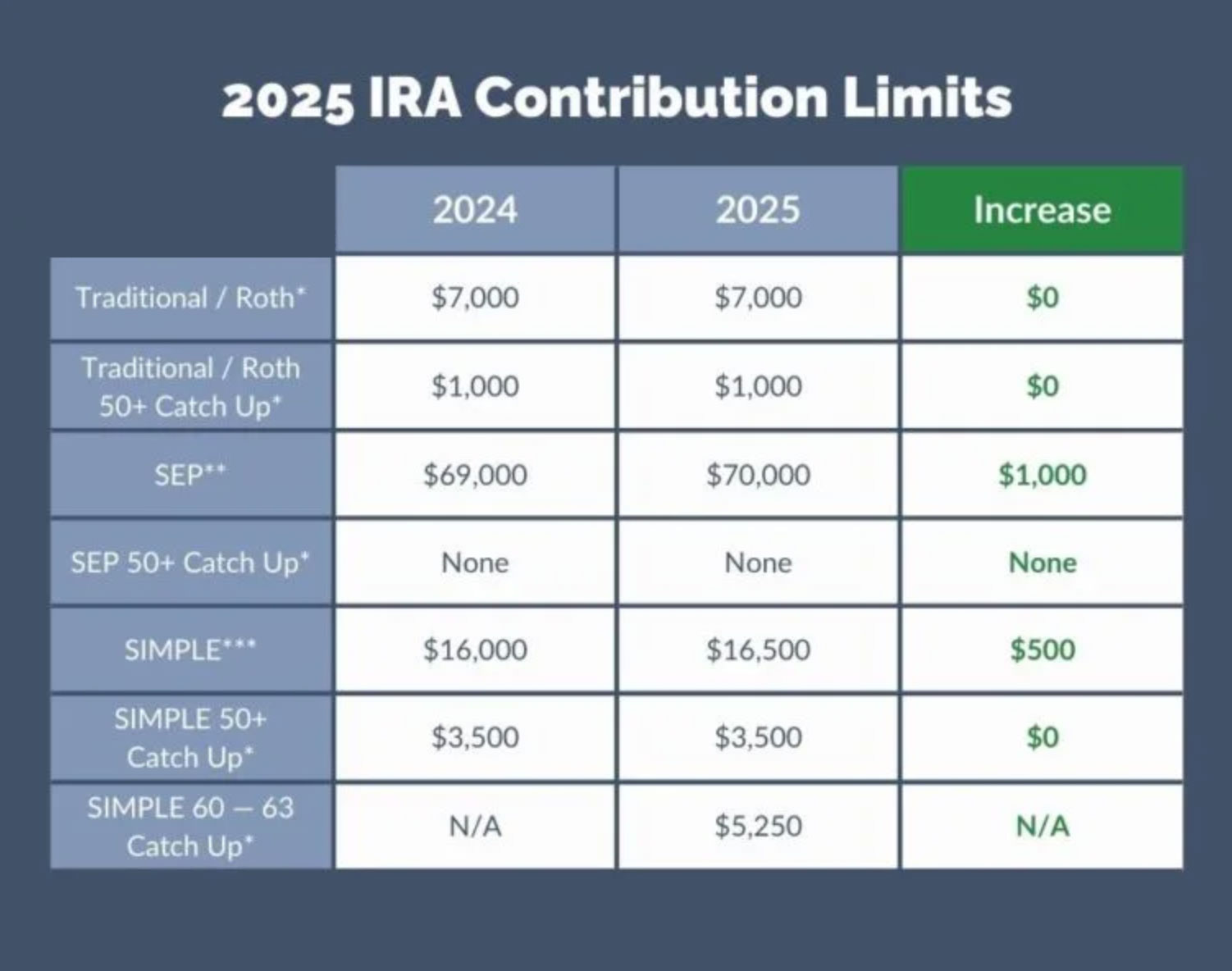

Contribution Limits Still Apply

Contributions to a Roth IRA after retirement are still subject to annual limits set by the IRS. For 2024, individuals under 50 can contribute up to $7,000 per year, and those 50 and older can contribute $8,000, including a $1,000 catch-up contribution. Just remember, your total contributions can’t exceed your earned income for the year, so plan accordingly.

Income Eligibility Requirements Remain

Another important factor in answering 'Can I contribute to a Roth IRA after retirement?' is taking into account income limits. For 2024, single filers with a modified adjusted gross income (MAGI) above $153,000 and joint filers above $228,000 are generally ineligible to contribute directly to a Roth IRA. If your income exceeds these thresholds, you might consider a Backdoor Roth IRA strategy where appropriate.

Using a Roth IRA for Estate Planning

Roth IRAs can also serve as powerful tools for estate planning. Because Roth accounts do not require minimum distributions during the account holder’s lifetime, you can allow your investments to grow tax-free. Heirs who inherit Roth IRAs often benefit from tax-free distributions, making this an attractive option for leaving a financial legacy to loved ones.

So, can you contribute to a Roth IRA after retirement? If you have earned income, the answer is yes. Whether through part-time work or utilizing spousal contributions, many retirees can still actively fund a Roth IRA and take advantage of its tax benefits. Always consult a financial advisor or tax professional to determine the best strategies based on your unique circumstances.