Often referred to as financial or retirement planning, estate planning is the process of determining how assets will be administered after death. Assets can include real estate, personal belongings, and investments. Estate planning is important for everyone, affluent or not.

Estate planning helps people strategize investments to ensure a comfortable retirement. After death, an estate plan ensures assets are distributed according to a person's wishes, making it easier for survivors to settle the affairs of loved ones.

Estate Planning: More Than a Will

Many people think of an estate as just a will, but it includes more than that. There’s the legal component that ensures a person's wishes are carried out after death, including documents like wills, powers of attorney and various trusts.

Then there’s the non-legal side. Individuals meet with specialists to review finances and develop investment strategies. Regardless of someone's financial situation, these strategies can help people live a more financially comfortable retirement.

Get an Inventory

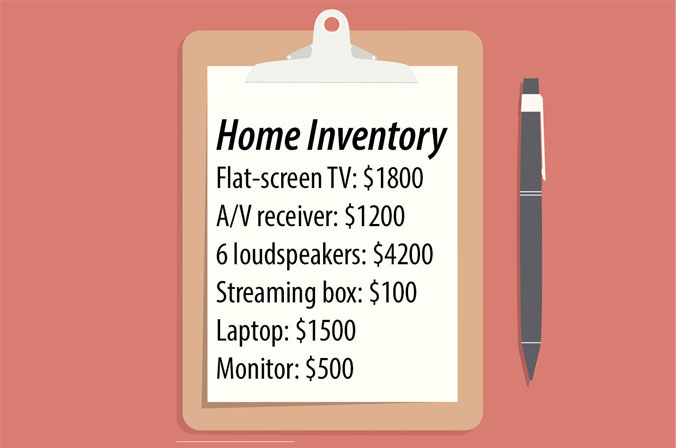

Many people are surprised by how many assets they actually have. These can include tangible assets, such as real estate, vehicles, or personal possessions, or intangible assets like stocks, bonds, life insurance policies, and retirement plans.

Once a clear inventory of tangible and intangible assets has been made, it's important to estimate values. Individuals can use outside valuation like appraisals to estimate real estate property value and value other items based on how much beneficiaries might value them.

What About Family?

Whether it’s children, a partner, or other family members, it’s important to consider their needs in estate planning. Someone who is married with kids should ensure they have adequate life insurance in case their family faces tough financial circumstances.

No one should assume their family knows their wishes. It's important to clearly identify guardians and childcare wishes to limit any legal complications if family members disagree and choose to take ambiguous wishes to court.

Document Must-Haves

There are a few necessary documents for estate planning. The first is a will and trust, which clearly states how assets are distributed. In case someone is incapacitated, they should also draft a power of attorney to instruct providers and a chosen agent how to make decisions on their behalf.

Other important documents include:

- Beneficiary designations

- Letter of intent

- Healthcare power of attorney

- Guardianship designations

Review and Reassess

As estate plans are updated, it's important to review documents and beneficiaries. They may sometimes include conflicting information, such as who gets what, causing later issues. For instance, what if someone forgets to take an ex-spouse off a life insurance policy and the current spouse doesn’t benefit?

Life and circumstances change, and estate plans should reflect that. Individuals should revisit estate plans whenever they take on new investments or experience major life changes, such as marriage, starting a business, or having a child.