The average 30-year mortgage rate dipped to 5.99% on December 12, 2025, as the Federal Reserve delivered its third consecutive interest rate cut in a bid to support a softening labor market. While the 0.25% reduction brought the federal funds rate to its lowest level since 2022, housing experts warn that mortgage rates remain stubbornly elevated, hovering near 6% and unlikely to see significant declines in the near term. For homebuyers and investors watching the financial landscape, understanding where rates stand today and where they're headed in 2026 could mean the difference between securing an affordable loan or being priced out of the market.

How the Fed's Rate Cut Is Shaping Today's Mortgage Landscape

Despite the Federal Reserve's December rate reduction, the average 30-year mortgage rate only moved down slightly to 5.99%, according to Zillow data reported by CBS News. The average 15-year mortgage rate stands at 5.37%, while refinance rates climbed to 6.77% for 30-year terms. This disconnect highlights a crucial reality: mortgage rates don't move in lockstep with the Fed's decisions. Unlike credit cards and personal loans that directly follow the federal funds rate, mortgage rates are tied to longer-term Treasury yields and mortgage-backed securities that have already priced in expected Fed actions.

"What we've been seeing recently gives us at least preliminary evidence that rates are going to be a little bit stickier than maybe you would expect from Fed policy," Jake Krimmel, a Realtor.com senior economist, told CNBC Select. The current mortgage rate of 6.3%, as tracked by Mortgage News Daily, remains dramatically higher than the sub-3% rates available during the pandemic era, though it's well below the 8% peak reached in October 2023.

From Peak to Plateau: The 2025 Mortgage Rate Timeline

The journey to today's mortgage rates has been marked by gradual declines throughout 2025. The year began with rates hovering around 6.7% after the Federal Reserve's first rate cut in March, which was followed by additional reductions in September and December. Each cut brought hopes of significant mortgage rate relief, but the decreases have been incremental at best. The 30-year fixed mortgage rate averaged 6.62% through most of 2025, only a tenth of a point lower than the 2024 average of 6.72%, according to CNBC analysis of Freddie Mac data.

This stubbornness reflects complex market dynamics. "Since this rate cut was no surprise, the markets have taken it in stride," said 43-year mortgage industry veteran Melissa Cohn, regional vice president of William Raveis Mortgage. She noted that future bond yields and mortgage rates will be determined by new data on jobs and inflation rather than Fed announcements alone.

Why Mortgage Rates May Not Fall Much Further in 2026

Housing economists across major organizations—including Realtor.com, National Association of Realtors, Redfin, and Fannie Mae—predict the 30-year fixed mortgage rate will average between 5.90% and 6.30% by the end of 2026. While this represents a decline from current levels, it's far from the dramatic drop many homebuyers have been hoping for. J.P. Morgan Research offers an even more conservative outlook, forecasting mortgage rates easing only slightly to 6.7% by the end of 2025 and remaining elevated through much of 2026.

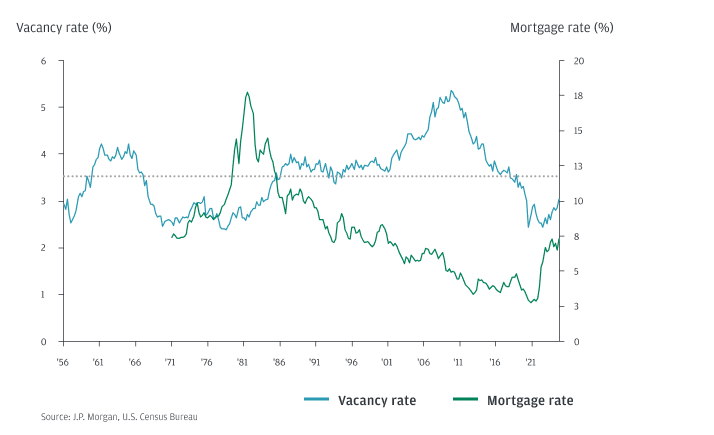

The research firm expects house prices to rise by 3% overall in 2025, compounding affordability challenges. "The situation is not going to change until we get mortgage rates back down toward 5%, or even lower," said John Sim, head of Securitized Products Research at J.P. Morgan. "And we aren't forecasting mortgage rates to breach 6% in 2025—they should ease only slightly to 6.7% by the year end."

The Lock-In Effect: How Current Homeowners Are Trapping Themselves

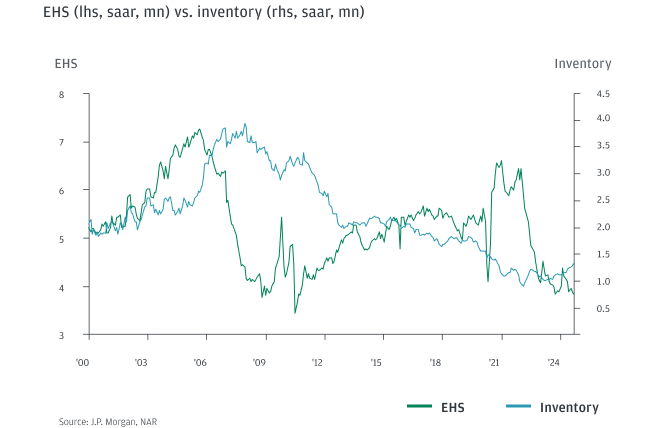

One of the most significant factors keeping housing inventory low—and prices high—is what economists call the "lock-in effect." More than 80% of borrowers have mortgage rates that are 100 basis points or more below current market rates, according to J.P. Morgan analysis. These homeowners face a significant disincentive to sell their properties and give up their low-rate mortgages, creating a severe shortage of available homes.

"The lack of supply is primarily a lock-in issue," Sim explained. "These are borrowers who have a significant disincentive to sell their home, and this is creating the dearth in supply." This dynamic has created a frozen housing market where existing home sales remain at exceptionally low levels, inventory stays well below historical averages, and prices continue to rise despite affordability challenges.

Where Mortgage Rates Stand Today and What Homebuyers Can Do

Current mortgage rates present both challenges and opportunities for different segments of the market. First-time homebuyers face the dual hurdles of high rates and elevated home prices, but several lenders are offering programs to help. Better Mortgage provides low rates through its online-only model with preapproval in as little as three minutes. Chase Bank offers its DreaMaker mortgage with just 3% down and grants up to $10,000 in certain markets. Rocket Mortgage continues to rank high in customer satisfaction with its ONE+ program that provides grants to qualified buyers.

For investors, the current environment presents different considerations. Real estate investors must factor in higher financing costs, but they may find opportunities in markets where price growth is slowing. The wealth effect from homeowners with substantial equity and stock market gains has helped maintain some demand, but investors should prepare for a market that may remain sluggish through much of 2026.

The Road Ahead: Policy Changes That Could Reshape Mortgage Rates

Looking toward 2026, several policy factors could influence mortgage rate trajectories. The Trump administration's housing policies remain uncertain but could have significant implications. Potential measures include streamlining zoning approval processes and making federal land available for construction—both aimed at increasing supply. However, proposed immigration reductions could cut construction labor supply by approximately 30%, potentially exacerbating affordable housing shortages.

Perhaps most significantly, discussions about privatizing government-sponsored enterprises like Freddie Mac and Fannie Mae could widen mortgage-backed security spreads, leading to even higher rates for borrowers if executed hastily. "It's evident that numerous aspects of Trump's policy will impact the housing market," Sim noted. "For now, though, all we can do is wait."

Key Takeaways for Homebuyers and Investors in 2026

Mortgage rates are expected to remain in the 6% range through much of 2026, with gradual declines possible but not dramatic drops. The lock-in effect will continue to suppress housing inventory, keeping prices elevated despite affordability challenges. Fed rate cuts have limited immediate impact on mortgage rates, which respond more to Treasury yields and market expectations. Homebuyers should focus on improving credit scores, saving for larger down payments, and exploring first-time buyer programs. Investors should prepare for continued market stagnation with selective opportunities in markets showing stronger fundamentals.

As Nadia Evangelou, NAR Senior Economist and Director of Real Estate Research, told CNBC Select: "A 50 to 60 basis points declining rate, combined with stronger income growth, makes homeownership more attainable." While the path to affordable housing remains challenging, understanding these dynamics provides the foundation for smarter financial decisions in the year ahead.