The most significant tax legislation since the Trump-era reforms of 2017 became law on July 4, 2025, when President Trump signed the One Big Beautiful Bill Act. This sweeping 870-page reconciliation bill not only makes permanent the popular provisions of the 2017 Tax Cuts and Jobs Act but introduces a suite of new deductions that could save American families thousands of dollars annually. For investors and financial planners, understanding these changes isn't just about tax season—it's about reshaping multi-year wealth strategies to maximize the benefits of what experts are calling "the tax code overhaul that will define the next decade."

How the One Big Beautiful Bill Unfolded: Inside the 2025 Tax Revolution

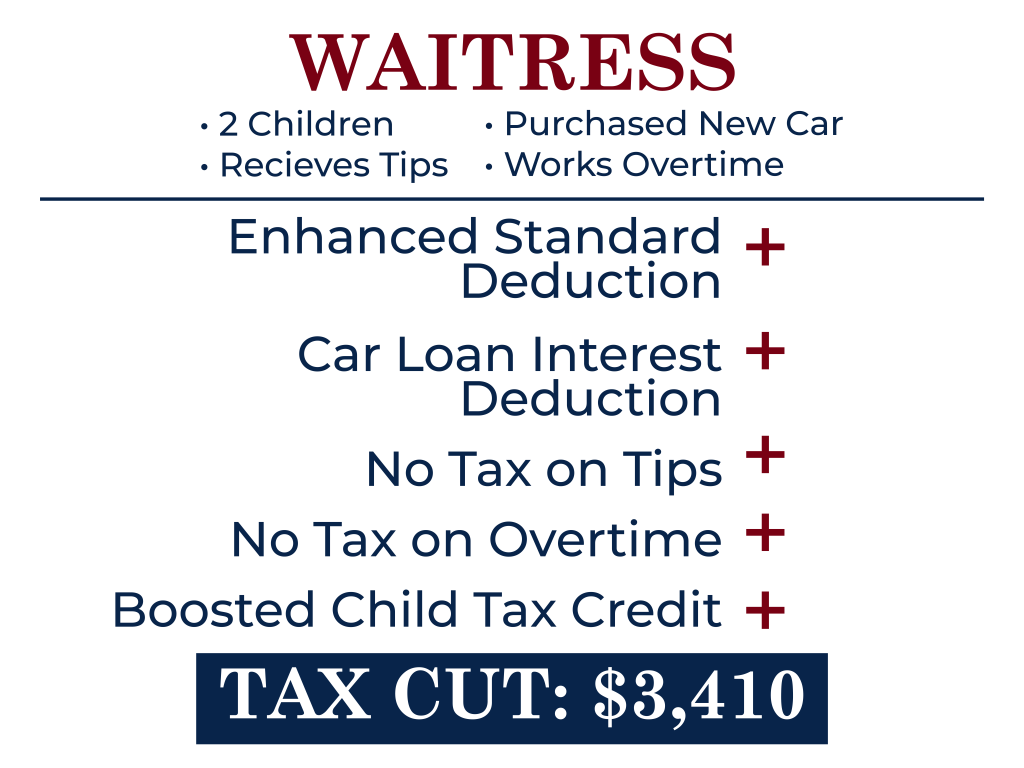

After months of intense negotiation and a dramatic late-night Senate vote on July 1, 2025, the One Big Beautiful Bill Act (Public Law 119-21) passed both chambers of Congress with razor-thin margins. The legislation represents the culmination of Republican efforts to prevent the scheduled expiration of the 2017 tax cuts while delivering on campaign promises to provide targeted relief to working families. According to the House Ways and Means Committee, the average American family will receive a $1,300 tax cut in 2026 compared to current law, with single mothers in tipped occupations potentially saving over $3,400 annually.

The IRS immediately began issuing guidance on the new provisions, with Fact Sheet FS-2025-03 released on July 14, 2025, detailing the four major new deductions available for tax years 2025 through 2028. "The One Big Beautiful Bill Act significantly affects federal taxes, credits and deductions," states the IRS official guidance, noting that the law "takes effect in 2025" with most provisions applying to returns filed in 2026.

Timeline: How the Tax Changes Roll Out Through 2026 and Beyond

The implementation of the One Big Beautiful Bill follows a carefully staged timeline designed to provide immediate relief while phasing in longer-term structural changes. For the 2025 tax year (returns filed in 2026), taxpayers can immediately claim the new deductions for tips, overtime, car loan interest, and seniors. The standard deduction increases to $31,500 for married couples filing jointly, $15,750 for single filers, and $23,625 for heads of household.

Beginning in 2026, the Child Tax Credit rises to $2,200 per child with annual inflation adjustments, while the lifetime gift and estate tax exemption jumps to $15 million (indexed for inflation). This is also when the controversial "Trump Accounts"—new tax-advantaged savings vehicles for children—become available, with the federal government making a one-time $1,000 contribution for each U.S. citizen born between 2025 and 2028.

Perhaps most significantly for financial planning, the State and Local Tax (SALT) deduction cap increases to $40,000 for 2025 through 2029 before reverting to $10,000 in 2030, creating a five-year window for strategic tax planning, particularly for residents of high-tax states.

Why These Tax Changes Matter for Your Investment Strategy

According to analysis from the Tax Foundation, the major tax provisions in the One Big Beautiful Bill will increase long-run GDP by 1.2 percent while reducing federal revenue by $5 trillion between 2025 and 2034. "The bill would prevent tax increases on 62 percent of taxpayers that would occur if the TCJA expired as scheduled," notes their comprehensive report, adding that the legislation "significantly improves incentives to invest in the American economy."

For investors, several key implications emerge. First, the permanence of the 2017 tax brackets (10%, 12%, 22%, 24%, 32%, 35%, and 37%) provides certainty for long-term planning. Second, the expansion of business provisions like 100% bonus depreciation and the Section 199A pass-through deduction creates enhanced opportunities for business owners and real estate investors. Third, the new deductions create what Baird Wealth Management calls "meaningful planning opportunities for virtually every taxpayer," particularly around income timing strategies to maximize phase-out thresholds.

"Taxpayers will need to be especially mindful as their income approaches these phaseout levels," cautions Baird's analysis. "Actions like a Roth conversion or realizing a capital gain could inadvertently push your income beyond these limits—causing the loss of valuable deductions and increasing the effective tax cost of those decisions."

Where Things Stand Now: Latest IRS Guidance and Implementation

As of August 2025, the IRS has issued transitional relief for several reporting requirements, particularly for lenders regarding car loan interest documentation and for employers tracking overtime and tip income. The agency has committed to publishing a list of "traditionally tipped occupations" by October 2, 2025, which will clarify eligibility for the tip income deduction.

H&R Block's detailed analysis notes that while some implementation details are still unfolding, "we've prepared an overview of the major updates, and we'll continue to keep you informed every step of the way." Their guidance emphasizes that the new deductions are available to both itemizers and non-itemizers, representing a significant expansion of tax benefits beyond the traditional itemized deduction framework.

One area generating considerable discussion among tax professionals is the vehicle interest deduction, which requires that qualifying vehicles undergo "final assembly in the United States" and that taxpayers include the Vehicle Identification Number (VIN) on their returns. The IRS has provided a VIN decoder tool through the National Highway Traffic Safety Administration to help taxpayers verify eligibility.

What Happens Next: The Road Ahead for Tax Planning

The phased implementation of the One Big Beautiful Bill creates unique planning opportunities over the next several years. Financial advisors are already developing strategies around "bunching" charitable contributions before 2026 (when new limitations take effect), accelerating business investments to maximize bonus depreciation, and restructuring compensation for tipped and overtime workers.

The introduction of Trump Accounts in 2026 will create new intergenerational wealth transfer opportunities, with annual contribution limits of $5,000 (indexed after 2027) and employer matching of up to $2,500. These accounts function similarly to traditional IRAs after the child turns 18, but with investment restrictions before that age.

Perhaps most critically, the temporary nature of several key provisions—particularly the SALT deduction increase and the four new deductions—creates a narrow window for strategic action. "Many taxpayers may consider accelerating or 'bunching' their 2026 charitable gifts into 2025, in order to maximize their tax value," advises Baird Wealth Management, suggesting donor-advised funds as an effective vehicle for this strategy.

The Bottom Line: Key Points Every Investor Should Remember

The One Big Beautiful Bill Act represents the most significant reshaping of the tax code in nearly a decade, with implications that extend far beyond annual tax preparation. The legislation provides immediate relief through new deductions for tips, overtime, car loans, and seniors while locking in favorable rates and brackets for the long term. For investors and financial planners, the bill creates both opportunities and complexities, particularly around phase-out thresholds and temporary provisions. As with any major tax change, working with qualified professionals to develop a multi-year strategy will be essential to maximizing benefits while avoiding unintended consequences in this new tax landscape.